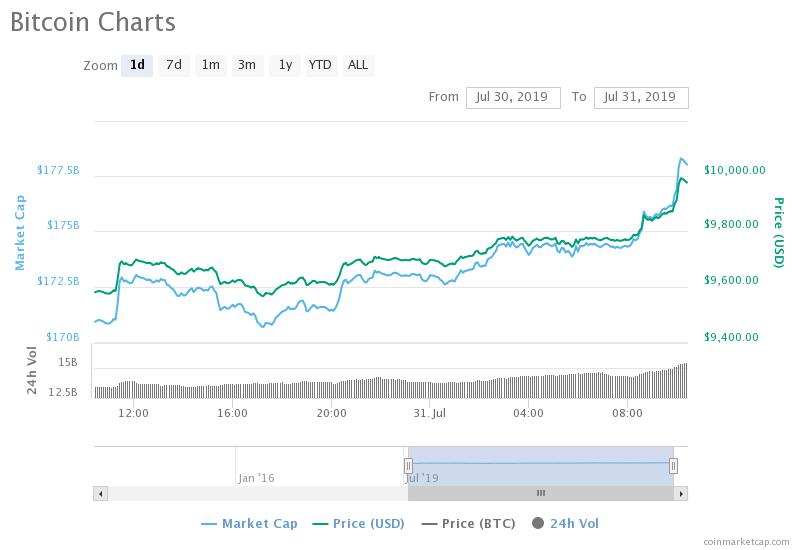

July was yet another strong month for the stock markets despite looming threat of a coming economic recession, with the Dow, Nasdaq, and S&P 500 all close to beating out their average monthly gains for the calendar month. Bitcoin, however, has spent much of July locked in a downtrend.

This morning as the Fed monetary policy meeting met its deadline to cut rates, the Dow Jones Industrial Average dropped sharply over the news. Around the same time, Bitcoin spiked above its local lows and could be signaling a bullish reversal is around the corner. As the two markets respond to the news, what’s next for each?

Dow Jones Industrial Average Drops After Federal Rate Cut

Today, the Federal Open Market Committee lowered the lending rate by 25 basis points. Worried stock market investors had begun the selloff late Tuesday into Wednesday, resulting in as much as a 450 point drop for the Dow following the announcement from Federal Reserve Chairman Jerome Powell.

Related Reading | Bitcoin Rises as Markets Expect Decade’s First Fed Rate Cut

Powell called the cut a “mid-cycle adjustment to policy,” and says that it’s “not the beginning of a long series of rate cuts.” But stock market investors were shaken regardless, resulting in the steep decline.

United States President Donald Trump had called for a cut of 50 basis points, so despite the reaction, Powell’s cut is modest by comparison.

Looming concerns surrounding the US and China trade war has only further fueled investor anxiety fearing the rate cut is just another ingredient in a recipe for economic disaster. During economic downturns, investors often sell off their stocks in exchange for “safe haven” assets and could be what is driving the selloff in the stock market.

Does Dow Dropping Bode Well for Bitcoin?

While stock market investors de-risk and separate themselves from US-driven stocks and indices, the outflow of capital typically goes somewhere. In the past, as economic turmoil heats up, so does the price of gold, and safe-haven currencies such as the Swiss franc or Japanese yen.

Related Reading | Prominent Investor: Mainstream Finance Is Now Considering Bitcoin As a Safe Haven Asset

In recent weeks, gold has captured media attention for kickstarting what many believe to be a bull run for the precious metal and investment asset. Gold’s scarcity and longevity make it a top choice during economic downtrends as a way to hedge against further decline. Both Bitcoin and gold have been showing correlated price movements.

Bitcoin was designed in the wake of the 2009 financial crisis and just experienced the first-ever federal rate cut since it existed. How it reacts from here is anyone’s guess. The crypto asset recently left its bear market lows and has risen alongside gold. Bitcoin is pitched as the digital version of gold, sharing many similarities.

Bitcoin, in the face of economic downturn, may finally show its true potential as a digital replacement for gold, and as the economic hedge creator, Satoshi Nakamoto had designed it to be. And as capital flees falling stock markets, Bitcoin very well could continue on its bull run from here and become the global currency replacement for fiat that many envision it to be.

The post Dow Jones Drops After Fed Rate Cut, What’s This Mean for Bitcoin? appeared first on NewsBTC.

Source: https://www.newsbtc.com/2019/08/01/dow-jones-fed-rate-bitcoin/