Bitcoin has been the subject of recent media attention, not only due to its price increase above $65,000 but also due to the extraordinary inflows into spot Bitcoin ETFs.

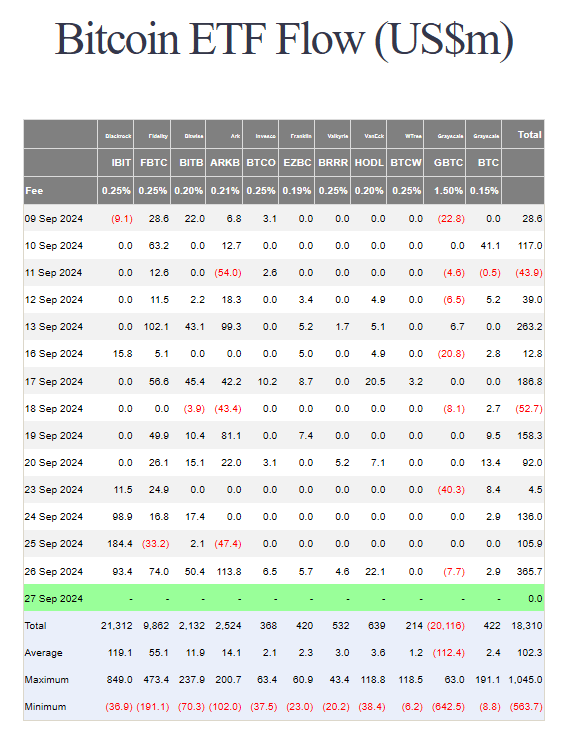

These inflows, according to Farside Investors, have reached a remarkable $365 million as of September 26, 2024, which is indicative of the increasing institutional interest in the cryptocurrency market.

Record Inflows Amid Market Optimism

The biggest daily flow for the month came from BlackRock’s Bitcoin ETF, which surged about $184 million on September 25, 2024.

This spike coincides with withdrawals from numerous other ETFs, indicating a significant change in institutional investors’ view. Although there were just $2.1 million in inflows into other platforms such as the Bitwise Bitcoin ETF, BlackRock’s performance is noteworthy and serves as a ray of hope among the market’s volatility.

For the past five days, there has been a positive cumulative inflow of around $497 million into US spot Bitcoin ETFs. The Federal Reserve’s recent move to lower interest rates by 50 basis points is partly the reason for this increase since it has prompted investors to look for other assets like Bitcoin.

The overall digital asset investment products have also seen a second consecutive week of inflows, totaling approximately $321 million, with BTC being the primary focus, accounting for about $284 million of that total.

Institutional Trust And Financial Aspects

The present surge of money into Bitcoin ETFs indicates a bigger trend in which institutional investors are beginning to view Bitcoin as a tactical asset. Further supporting the positive outlook are economic factors such the Federal Reserve’s dovish stance, which has calmed investors about likely economic stability.

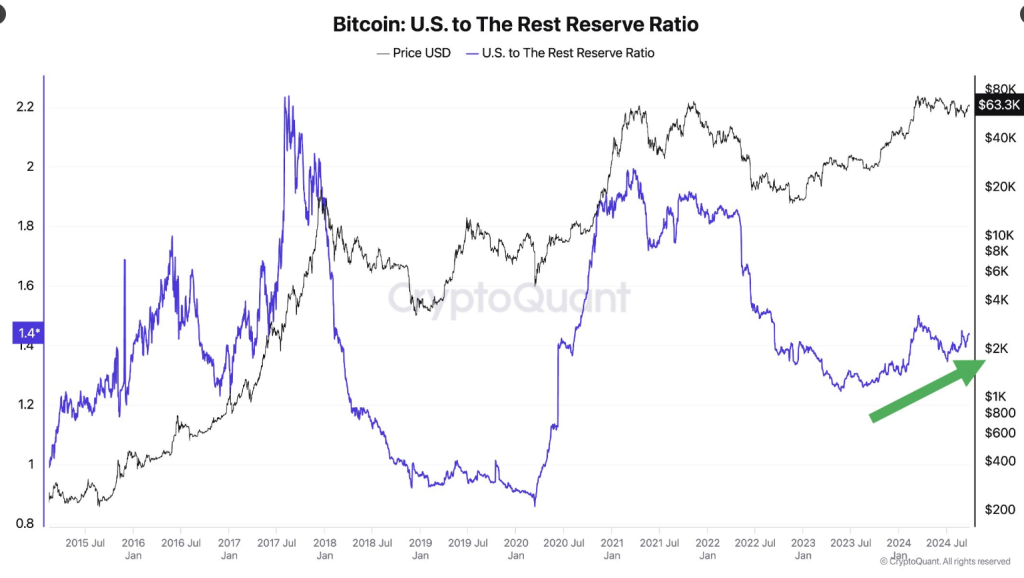

The CEO of CryptoQuant, Ki Young Ju, stressed that strengthening the US’s standing as a pioneer in the cryptocurrency space depends on the increasing demand for spot Bitcoin ETFs.

The

U.S. is regaining dominance in #Bitcoin holdings. Its ratio compared to other countries is rising, driven by spot ETF demand. Only known entities are included. pic.twitter.com/a9XOb5134E

— Ki Young Ju (@ki_young_ju) September 26, 2024

It’s interesting to note that although BlackRock’s ETF performs well, other ETFs, including Ark 21Shares Bitcoin ETF and Fidelity’s Wise Bitcoin Origin Fund, have seen large withdrawals of $33.2 million and $47.4 million, respectively.

The Investment Landscape For Bitcoin In The Future

As Bitcoin’s value and popularity continue to grow, analysts are keeping a careful eye on how these inflows could affect future price moves.

Over 90% of Bitcoin holders are currently in profit due to this price surge, which raises concerns about potential sell-offs as investors look to realize gains. Based on past patterns, significant price adjustments could take place should a sizeable fraction of holders show gains.

To make matters more complicated, there are about $5.8 billion worth of options contracts that are about to expire. Traders will be watching $66,000 and other important resistance levels closely, as a break over this level may spark additional positive momentum.

Featured image from WIRED, chart from TradingView