BlackRock, Franklin, Bitwise, Invesco, Grayscale, and Fidelity have filed amended S-1 forms for their Spot Ethereum ETFs, paving the way for a possible listing next week.

This is a major development in the firms’ quest to receive approval from the U.S Securities and Exchange Commission (SEC) given that the firms are setting their management fees an indication that they are in their final stages of preparing for trading.

BlackRock, Franklin, Bitwise, Invesco, Grayscale, Fidelity Fees

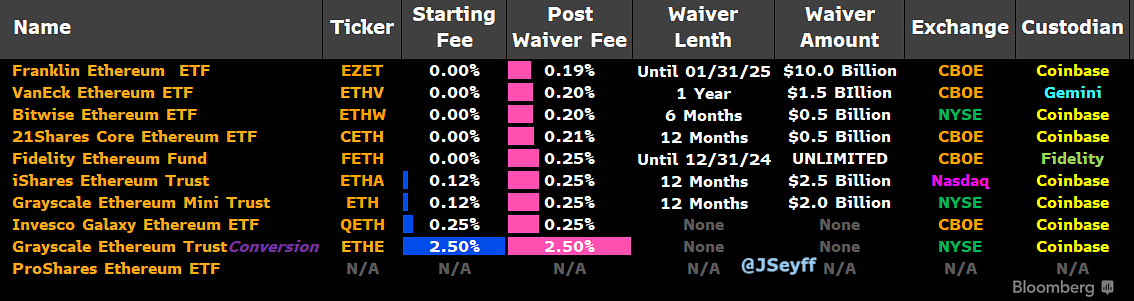

BlackRock, an asset management firm, has quoted 0.25% fee for its spot Ethereum product. In the amended S-1 registration statement, the firm pointed out that it is entitled to “waive all or a portion of the fee for any period(s).” The fee is charged on a daily basis with an annualization and is due and payable on a quarterly basis.

Another major player, Bitwise, also declared a 0.20% fee with an initial discount for 6 months for the first $500 million in assets. Nevertheless, Grayscale charges a higher fee of 2.5% for its Ethereum Trust as compared to the other issuers. Grayscale’s mini Ethereum ETF, however, which is also expected to be launched at the same time as the others, will have a 0.25% fee with a waiver of up to $2 billion or up to 12 months.

Invesco Galaxy charges a fee of 0.25%, which is equal to BlackRock, while VanEck charges 0.20%. However, while Invesco Galaxy does not offer a waiver, VanEck offers a$1.5 Billion or 12 months waiver. Out of all the firms, Franklin Templeton has the lowest fee set at 0.19% with a waiver of $10 Billion until January 31st 2025. Fidelity also introduced 0.25% fee but the company declared it is going to exempt from this fee up to the end of 2024.

Earlier today, the ETF issuer 21Shares had revealed a 0.21% fee for its Ethereum ETF, which will be exempt for the first six months or until the asset of the trust will be $500 million.

Spot Ethereum ETFs Expected Launch Approval

Several sources suggest that the Spot Ethereum ETFs will start trading from Tuesday. This comes after the US Securities and Exchange Commission (SEC) gave the green light to critical 19b-4 forms for eight physically settled Ethereum ETFs on May 23.

It is a requirement that any issuers must have their registration statements effective before they can start selling securities.

According to the senior Bloomberg ETF analyst Eric Balchunas, the SEC asked for the final S-1 forms from the issuers and planned to declare effectiveness on July 22, with the launch following on July 23. This timeline indicates that the firms are in the last cycle before they complete the approval process with the SEC.

SEC Approves Grayscale and ProShares

The US SEC has given the green light to two spot Ethereum exchange-traded funds (ETFs) namely Grayscale Ethereum Mini Trust and ProShares Ethereum ETF to list on the New York Stock Exchange (NYSE)’s Arca electronic platform as revealed on 17th July.

The approval of the Form 19b-4 filing allows NYSE trade the funds on behalf of the company. Nevertheless, the issuers have to wait for the final comments on the S-1 filings of the ETFs before the spot products can start trading.

Grayscale revealed its intention to transfer the shares of the new Mini Trust to the owners of the ETHE fund. The Grayscale Ethereum Trust was launched in 2017 and was one of the earliest ways institutional investors could invest directly in Ethereum. Therefore, eight spot Ether ETFs are set to receive the final regulatory nod as early as July 23 after weeks of discussions with the SEC and changes to the S-1 filings of the funds.

Read Also: Polygon Price Prediction: MATIC Eyes End-of-Correction Trend With This Breakout

The post BlackRock, Franklin, Bitwise, Invesco, Grayscale, Fidelity File Updated Spot Ethereum ETF S-1 appeared first on CoinGape.