For the Bitcoin and crypto market, the upcoming week promises to be a pivotal one. While the US Consumer Price Index (CPI), Jobless Claims, Producer Price Index (PPI) and Michigan Consumer Sentiment are all on the horizon, three events stand out as particularly: the July release of the CPI and PPI data, as well as the much-anticipated Bitcoin ETF decision for ARK Invest.

Consumer Price Index (CPI) On Thursday (8:30 am EST)

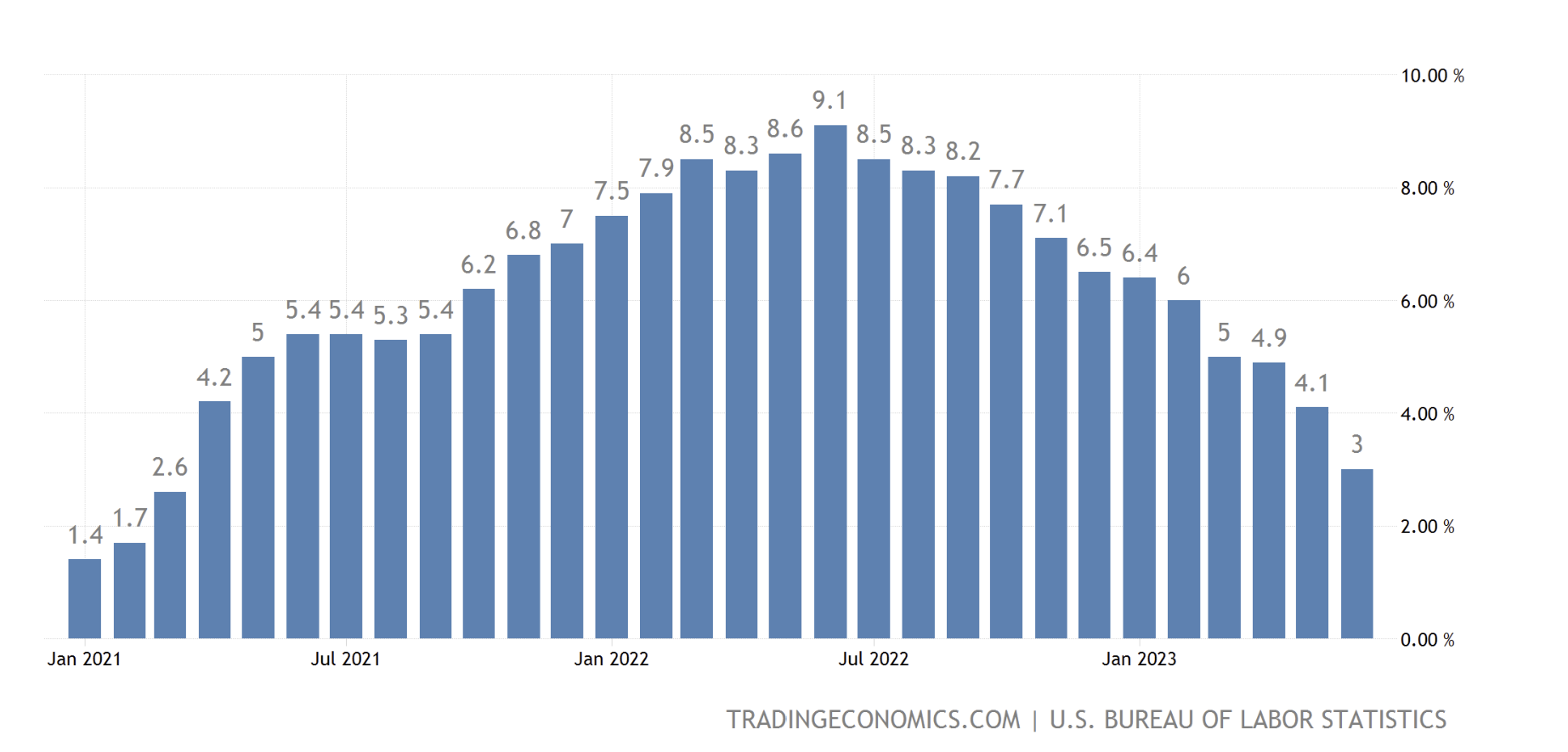

The CPI, a key measure of inflation, has been under the microscope as the US grapples with fluctuating inflation rates. The headline CPI is expected to rise from 3% to 3.3% YoY in July, a notable shift as beneficial base effects from the previous year begin to fade. The Cleveland Fed’s Inflation Nowcast model even forecasts a 3.42% headline CPI, slightly above the consensus.

After the Federal Reserve raised interest rates another 25 basis points in July, 84.5% of the market currently assumes there will be no further rate hikes at the next FOMC in September, according to the CME FedWatch Tool. However, a re-acceleration in inflation data could turn expectations entirely around. Remarkably, there will be two CPI data releases before the next FOMC meeting from September 19-20. If both times inflation picks up after peaking at 9.1% and 13 consecutive months with a drop in headline CPI, this would be a worst-case scenario for the financial markets.

A special focus will be on core CPI, which excludes volatile food and energy prices. With last month’s figure at 4.8%, predictions for July hint at a slight deceleration to 4.7%.

However, with oil prices surging – as pointed out by Peter Schiff’s recent tweet highlighting its potential impact on CPI – the path of inflation remains uncertain. Schiff remarked on Twitter:

Oil closed the week above $82, the 6th consecutive weekly gain. The price is now up 30% from the May low. Momentum is building and the oil price will likely exceed $100 soon. This will put upward pressure on the CPI, pushing the Fed further away from its 2% inflation target.

A rising CPI could signal to the Federal Reserve that further interest rate hikes may be necessary, a move that could have ripple effects across the Bitcoin and crypto market.

Producer Price Index (PPI) On Friday (8:30 am EST)

The PPI, which measures the average change in selling prices received by domestic producers for their output, is often seen as a leading indicator for the CPI. Last month’s PPI YoY was a mere 0.1% (YoY), teetering on the brink of negative territory. However, forecasts for July suggest a rebound to 0.7%.

On a monthly basis, the PPI rose 0.1% in June (0.2% was expected). It is expected to rise again by 0.2% in July. A rising PPI could foreshadow re-accelerating CPI data as producers are passing on increased costs to consumers, potentially leading to a subsequent rise in the CPI. For the Bitcoin and crypto market, a higher-than-expected PPI could stoke fears of a second wave of inflation, influencing investor sentiment and strategies.

Bitcoin ETF Decision For ARK Invest On Friday

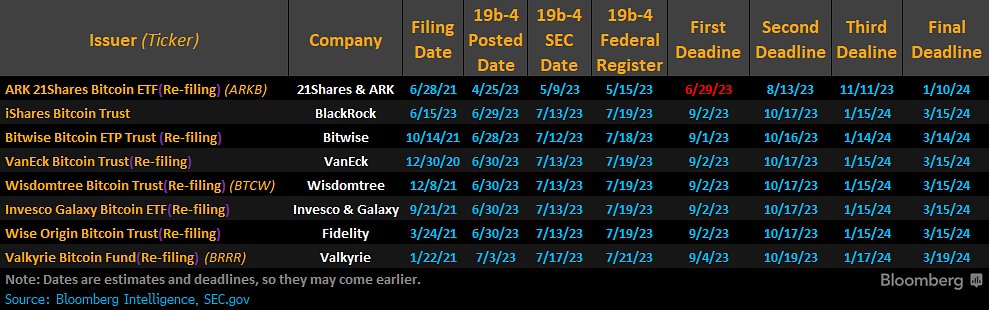

One the biggest catalysts for the market could undoubtedly be the approval of a Bitcoin spot ETF and the race for a bitcoin spot ETF is slowly heating up. At least in terms of deadlines, Cathie Wood’s Ark Invest is the first to get a decision.

While BlackRock, Fidelity, Invesco and the other financial giants wait for an initial response from the SEC, Ark Invest is already one step ahead. The US Securities and Exchange Commission (SEC) has already delayed Ark’s filing once. On Sunday, August 13, the SEC’s second deadline expires.

The SEC must decide whether to approve the application, reject it or extend the review period again. In total, the SEC can do this four times, for a total of 240 days. The majority of experts assume that the SEC will again push back Ark’s application. However, given the new tones of SEC Chairman Gensler, a surprise cannot be ruled out.

Late Friday evening could therefore hold some huge news. However, if the SEC postpones the Ark filing, Bitwise would be next, on September 1, before the first deadline for BlackRock, VanEck, WisdomTree, Invesco and Fidelity on September 2.

At press time, the Bitcoin price stood at $29,079.

Source: https://bitcoinist.com/major-week-ahead-bitcoin-crypto-3-must-watch/