Uniswap Price Prediction 2022-2031

- Uniswap Price Prediction 2022 – up to $7.46

- Uniswap Price Prediction 2025 – up to $17.18

- Uniswap Price Prediction 2028 – up to $23.80

- Uniswap Price Prediction 2031 – up to $43.19

Ethereum has undergone a series of upgrades toward its next version, Ethereum 2.0. Unfortunately for Uniswap, the upgrades are taking a long time and affect Uniswap in terms of long processing time and high gas fees. However, there are means by which the price impact could be reduced but before we get into these methods, let’s have a backgrounder on Uniswap and its token UNI. With this Uniswap price prediction, let’s determine if those who invest in the UNI V3 will get 3x profit

The introduction of the v3 factors could help propel Uniswap cryptocurrency prices skywards, especially considering the available data shows that the update has already helped Uniswap become the largest DEX on the Ethereum network. Lower transaction fees have also made Uniswap more accessible to a new class of users.

Uniswap is a decentralized exchange built on Ethereum’s blockchain. Decentralized exchanges (DEXs) like Ethereum let investors or users swap cryptocurrency and data without needing to make an account with a centralized cryptocurrency platform like Coinbase or Binance. The platform transacts north of a billion dollars in cryptocurrency daily, and it’s the most used exchange for crypto and data transfer in the world.

Today’s Uniswap price today is $6.11 with a 24-hour trading volume of $57,351,821. Uniswap is up 1.15% in the last 24 hours. The current CoinMarketCap ranking is #18, with a live market cap of $4,658,712,817. It has a circulating supply of 762,209,327 UNI coins and a max. supply of 1,000,000,000 UNI coins.

Let’s take a look at UNI’s fundamentals, analyze the past prices and find out what experts are saying about its future price actions.

Also Read:

- Uniswap price analysis: UNI/USD rises to $7.07 after a massive bullish run

- Staking on Uniswap for Passive Income

- Extreme crypto fear is a good buying opportunity?

Overview

Uniswap was created on 2 November 2018 by Hayden Adams, a former mechanical engineer at Siemens. He informed his followers through Twitter that it is only a few weeks since the launch of the Uniswap v3, and it is already the highest volume DEX protocol on OxPolygon.He further noted that its price is only $45million on TVL too.

Uniswap (UNI) is one of the most prominent decentralized finance (DeFi) exchanges. The DeFi protocol was founded in 2018 by former mechanical engineer Hayden Adams. The Uniswap exchange functions as a 100% on-chain automated protocol market maker on the Ethereum blockchain. It allows DeFi users to swap ether (ETH) for any ERC-20 token without intermediaries, solving many of the liquidity problems most exchanges face.

How does Uniswap work?

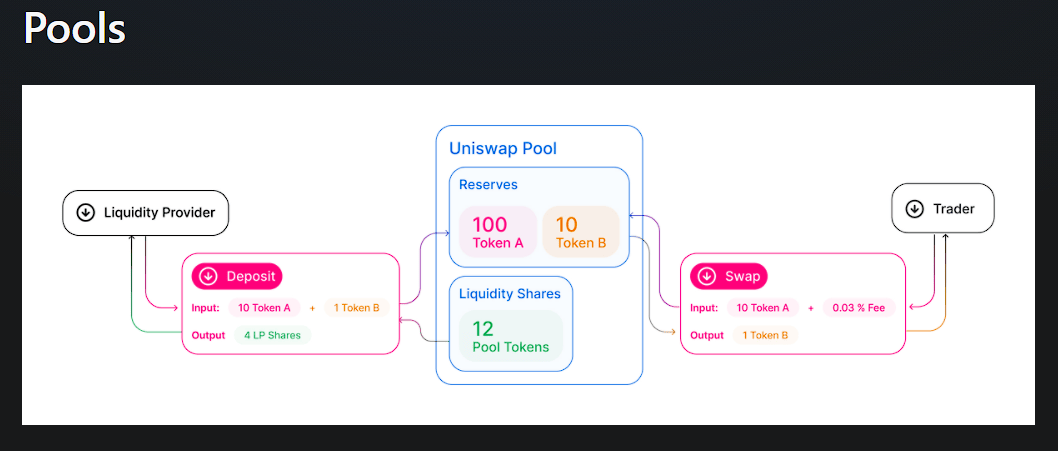

Uniswap pioneered the Automated Market Maker model, in which users supply Ethereum tokens to Uniswap “liquidity pools”, and algorithms set market prices based on supply and demand (as opposed to order books matching bids and asks from users on a centralized exchange like Coinbase).

By supplying tokens to Uniswap liquidity pools, users can earn rewards while enabling peer-to-peer trading. Users supply tokens to liquidity pools, trade tokens, or even create and list their own tokens (using Ethereum’s ERC-20 token protocol). There are currently hundreds of tokens available on Uniswap, and many popular trading pairs are stablecoins like USDC.

Some of the potential advantages of decentralized exchanges like Uniswap include:

- Self-governing: Funds are never transferred to any third party or are generally subject to counterparty risk (i.e. trusting your assets with a custodian) because both parties are trading directly from their own wallets.

- Global and permissionless: There is no concept of borders or restrictions on who can trade. Anyone with a smartphone and an internet connection can participate.

- Ease-of-use and pseudonymity: No account signup or personal details are required.

Uniswap Smart Contracts

Uniswap is just a bunch of smart contracts that work together to make a decentralized exchange. Smart contracts are uploaded to the blockchain, and since it’s on the blockchain, the code has the same immutable, decentralized, and borderless capabilities as cryptocurrencies. Smart contracts can transfer money autonomously based on the parameters in the code, allowing for highly efficient financial services.

Investors send their cryptocurrency or coin funds to a Uniswap smart contract to earn interest on their holdings; these investors are referred to as liquidity providers. The smart contracts that hold their cryptocurrency are called liquidity pools.

Liquidity providers are necessary for Uniswap to operate, as it’s how they can provide liquidity to trade on the platform. Instead of ordering books, the smart contract calculates the price of each cryptocurrency market asset. This is how a Uniswap smart contract works.

Why do people trust UNI?

People have become aware that one can not turn a billionaire in the short term or long term when you invest wisely in crypto. Hence they buy tokens based on the coin’s long-term actual performance. This is all the more reason for you to be in UNI for the long term, not the short-term gains.

Why is UNI keeping steady despite the bear market?

The credit goes to the faith investors have reposed in the asset. At the same time, it is an excellent reason that UNI is listed on the exchange to show excellent performance. This triggers investor response and shows a great deal of motivational sentiment—no wonder the token shows a constant up-rise consequently. Our perfectly optimized content goes here!

Uniswap is just a bunch of smart contracts that work together to make the decentralized exchange. Smart contracts are uploaded to the blockchain, and since it’s on the blockchain, the code has the same immutable, decentralized, and borderless capabilities as cryptocurrencies. Smart contracts can transfer money autonomously based on the parameters in the code, allowing for highly efficient financial services.

Investors send their cryptocurrency or coin funds to a Uniswap smart contract to earn interest on their holdings; these investors are referred to as liquidity providers. The smart contracts that hold their cryptocurrency are called liquidity pools.

Liquidity providers are necessary for Uniswap to operate, as it’s how they can provide liquidity to trade on the platform. Instead of ordering books, the smart contract calculates the price of each cryptocurrency market asset. This is how a Uniswap smart contract works.

How to reduce price impact on UNI

- Change the Uniswap Exchange Version. Choose among the Uniswap versions, V1 (old version) and V2 and new version V3. On the bottom navigation bar, you will select V1 as the version you want to use to transact the swap. You will check that you understand the disclaimer and click on continue with V1 for the transaction.

- Break down transactions and reduce the number of purchases. The price impact mechanism are problematic for big transactions. This problem can be solved by reducing the number of assets for trade and buy or sell the desired amount of transactions.

- Changing the price slippage tolerance. Due to excessive price fluctuations and the lengthy process of registering a buy or sell transaction in decentralized exchanges, an increase in price slippage helps to complete the transaction.

Uniswap Historical Price Analysis

Although the decentralized exchange (dex) has been around since 2018, it wasn’t until 2020 that the Uniswap cryptocurrency token came into existence. In the first year of its release, it had an initial price of just $3.00. However, because of the ferocious hype surrounding it, Uniswap price change increased to $7.00 by 19 September 2020, according to CoinMarketCap.

After the hype and excitement began to wind down, the price also began to fall, but it did not experience a drastic price change than other tokens, nor was its all-time low after the fact. Its all-time low was at $1.03 on 17 September 2020, before its price increase, according to CoinGecko.

Although, CoinMarketCap states its all-time low to be $0.4190 on that same day. It experienced its all-time high of $8.44 only a day after it began to calm down and decline. UNI’s price continued to decline as the months rolled by, although it never went below $2 before it again began to slowly increase in price, thanks to the 2020 bull run.

UNI finished the year 2020 with a price of $5.00. Since then, it has continued to increase, being on the verge of surpassing its former all-time high.

Uniswap operates on a decentralized P2P exchange automated market maker (AMM), away from conventional cryptocurrencies. Before we dig into the Uniswap price prediction, let us have a look at some of the unique features of Uniswap.

Being linked to Ethereum enabled as two smart contracts, Uniswap has a unique provision of liquidity providers (LPs). This unique feature of Uniswap acts as a significant catalyst in entirely removing the hurdle concerning token mining. In a manner, it promotes transparency by eliminating intermediaries or permission.

Hence, digital assets are linked as pairs instead of individual cryptocurrencies. As a decentralized protocol for automated liquidity provision on Ethereum, Uniswap took the entire crypto space by surprise during the pandemic; Uniswap decided to launch this token UNI on 17 September 2020.

Uniswap New Development

Uniswap secures $165 million in Series B funding to facilitate the propagation of the network’s security and simplicity to more people globally.

Also, in October 2022, Uniswap Labs announced the launching of Uniswap v3 on 5 different chains, with more coming. Uniswap v3 offers a massive liquidity base compared to several centralised exchanges, and liquidity providers also get better fees.

Uniswap Technical Analysis

Uniswap Protocol Token has broken the rising trend channel in the short term and reacted strongly down. For the time being, it is difficult to say anything about the future trend direction. The currency has broken down through support at $5.90, which predicts a potential further decline. In the case of positive reactions, there will now be resistance at 45.90.

A positive volume balance shows that volume is higher on days with rising prices than on days with falling prices. This indicates increasing optimism among investors. In the short term, UNI is overall assessed as technically negative for short-term investment.

Uniswap Protocol Token has broken through the ceiling of a falling trend channel in the long term, indicating a slower falling rate initially or the start of a more horizontal development. An inverse head and shoulders formation is under development.

A decisive break of the resistance at $8.15, ideally with an increase in volume, signals a further rise. There is no support on the price chart, and further decline is indicated. In case of a positive reaction, the currency has resistance at $7.00. A positive volume balance indicates that buyers are aggressive while sellers are passive, strengthening the coin.

Uniswap Price Predictions by Cryptopolitan

Uniswap will begin recovering in 2023 as the crypto market recovers from the crypto winter. It is impossible to tell when Uniswap will hit bottom, but it is undoubtedly undervalued and will be profitable in the coming years. Let’s take a look at the year to year UNI price increases.

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

|---|---|---|---|

| 2022 | $5.18 | $6.00 | $7.46 |

| 2023 | $9.09 | $9.98 | $11.15 |

| 2024 | $12.00 | $12.92 | $14.20 |

| 2025 | $14.84 | $15.78 | $17.18 |

| 2026 | $15.92 | $16.92 | $18.28 |

| 2027 | $18.06 | $19.14 | $20.49 |

| 2028 | $21.34 | $22.44 | $23.80 |

| 2029 | $26.08 | $27.18 | $28.60 |

| 2030 | $32.48 | $33.55 | $35.01 |

| 2031 | $40.65 | $41.71 | $43.19 |

UNI Price Prediction 2022

Our UNI price prediction 2022 expects a 22.29% gain on the current price, leading to a maximum price of $7.46 by the end of the year. An average trading price of $6.00 is expected, with the coin reaching a minimum price of $5.88.

Uniswap UNI Price Prediction 2023

Uniswap is expected to reach a maximum price of $11.15 based on our UNI price prediction 2023. We anticipate a minimum price of $9.09, and the digital coin will maintain an average price of $9.98. With the continued growth of the Uniswap protocol, it is assumed that the price will experience positive momentum.

UNI Price Prediction 2024

According to our UNI price prediction 2024, we foresee an overall bullish trend leading to a maximum price of $14.20. The token will trade at an average price of $12.92 and a minimum price of $12.00, respectively.

UNI Price Prediction 2025

Uniswap is anticipated to trade as high as $17.18 based on our UNI price prediction 2025. We expect the digital coin to continue its bullish run from the previous year while keeping a minimum and average price of $14.84 and $15.78, respectively.

UNI Price Prediction 2026

According to our UNI price prediction 2026, Uniswap will reach a maximum price of $18.28. The token’s minimum forecast price is $15.92 while maintaining an average price of $16.92.

Uniswap UNI Price Prediction 2027

Our UNI price prediction 2027 expects further price growth for the digital coin, leading to a maximum price of $20.49. We foresee an average price of $19.14 and a minimum of $18.06.

Uniswap allows free listings of cryptocurrencies, including new tokens; this allows ERC-20 tokens to be launched on the Uniswap platform and could lead to massive use of the platform, increasing the UNI token’s utility.

UNI Price Prediction 2028

Uniswap could reach a peak price of $23.80 based on our UNI price prediction 2028. The digital coin is expected to maintain an average price of $22.44 and a minimum of $21.34. The crypto space is developing, and the level of adoption is expected to increase massively over the years. If Uniswap receives a lot of attention up till 2028, the value of UNI could rise significantly.

Uniswap UNI Price Prediction 2029

According to our UNI price prediction 2029, Uniswap will trade at a maximum trading price of $28.60 and an average price of $27.18. The minimum UNI token price is $26.08.

UNI Price Prediction 2030

According to our UNI price prediction 2030, we expect a 473.93% increase in the current price, leading to a maximum token price of $35.01. This indicates that the token could be a suitable long-term investment. We anticipate an average price of $33.55 and a minimum of $32.48.

Uniswap UNI Price Prediction 2031

Based on our UNI price prediction 2031, Uniswap is expected to maintain its bullish momentum, leading to a maximum token price of $43.19. It is assumed that the token’s minimum price will be $40.65, and its average price will reach $41.71. The benefits offered by the Uniswap platform would expand its adoption in the coming years, increasing the token’s market value.

Wallet Investor Uniswap Price Prediction

According to WalletInvestor’s Uniswap forecast, UNI would have an adverse price movement in the next year, falling to as low as $0.473, making the token a bad long-term investment. However, slight price gains are expected over the next 14 days leading to a maximum token price of $6.616

Trading Beasts Uniswap Price Prediction

TradingBeasts’ Uniswap price forecasts anticipate an uptrend from November till the end of the year, leading to a maximum token price of $7.42 and an average price of $5.94. They expect a bullish start and end to 2023, with UNI trading around $10 by December 2023.

In 2024, TradingBeasts expects UNI to trade at a maximum price of $13.5 and a minimum price of $9.22. The token is predicted to attain a peak price of $16.35 in 2025 and a minimum price of $11.11.

Longforecast Uniswap Price Prediction

Longforecast expects Uniswap to end the year with a bearish momentum resulting in a price range of $5.18 to $5.96 by December. Further price drops are expected in 2023, leading to a closing price of $1.81. Longforecast expects small gains in 2024, resulting in a trading range of $3.14 to $3.62. According to the Uniswap price forecast from Longforecast, a maximum future price of $4.10 is expected in 2025, with a minimum trading value of $3.27.

Uniswap Price Predictions by Industry Influencers

@Jacob Crypto Bury, a crypto analyst, gives a detailed analysis of the price movement of Uniswap.

I’m extremely optimistic about the future of Uniswap and not because of the fee switch in particular (though I think it can be used as a lever for growth).

Erin Koen

Conclusion

Uniswap is a decentralized exchange built on the Ethereum blockchain. With the Ethereum network’s Merge update completed, the Uniswap protocol is expected to operate at a higher level of scalability. Users will no longer have to trade higher costs for better performance. With the launching of Uniswap v3, experts expect the uniqueness and efficiency of the network to reach more people around the world.

Uniswap will begin recovering in 2023 as the crypto market recovers from the crypto winter. It is impossible to tell when Uniswap will hit bottom, but it is undoubtedly undervalued and will be profitable in the coming years. Despite not sustaining its pricing beyond a honeymoon period, the Uniswap protocol has proven to be useful for early adopters. Analysts, however, are a little more cautious moving forward since the Uniswap protocol’s success is crucial.

Furthermore, Uniswap is also famous for its commitment to growth. Not too long ago, its community members voted to create a Uniswap Foundation, focusing on improving community governance and distributing grants to several projects in the Uniswap ecosystem. Also, WEB3 advancements will be a significant fuel; however, unfavourable legislation and market crashes will derail the positive performance of Uniswap.

Please be advised that all predictions for UNI cryptocurrency prices are extremely speculative and do not represent sound financial advice. Any significant investment demands thorough investigation and advice from knowledgeable professionals. Always use caution when trading, and never risk more money than you can afford to lose. Doing your own research is highly advised when investing.