Many have drawn similarities between DeFi and the ICO craze of 2017, and it’s easy to see why as well.

To begin with, both operate(d) primarily on the Ethereum network. However, it’s the flood of fly by night projects that links the two in the minds of many.

With that, in recent times, critics have not been short of material to bash the DeFi sector. Much like the ICO situation, their underlying concerns come down to scam projects, with no intention of delivering, leaving investors to hold the bags.

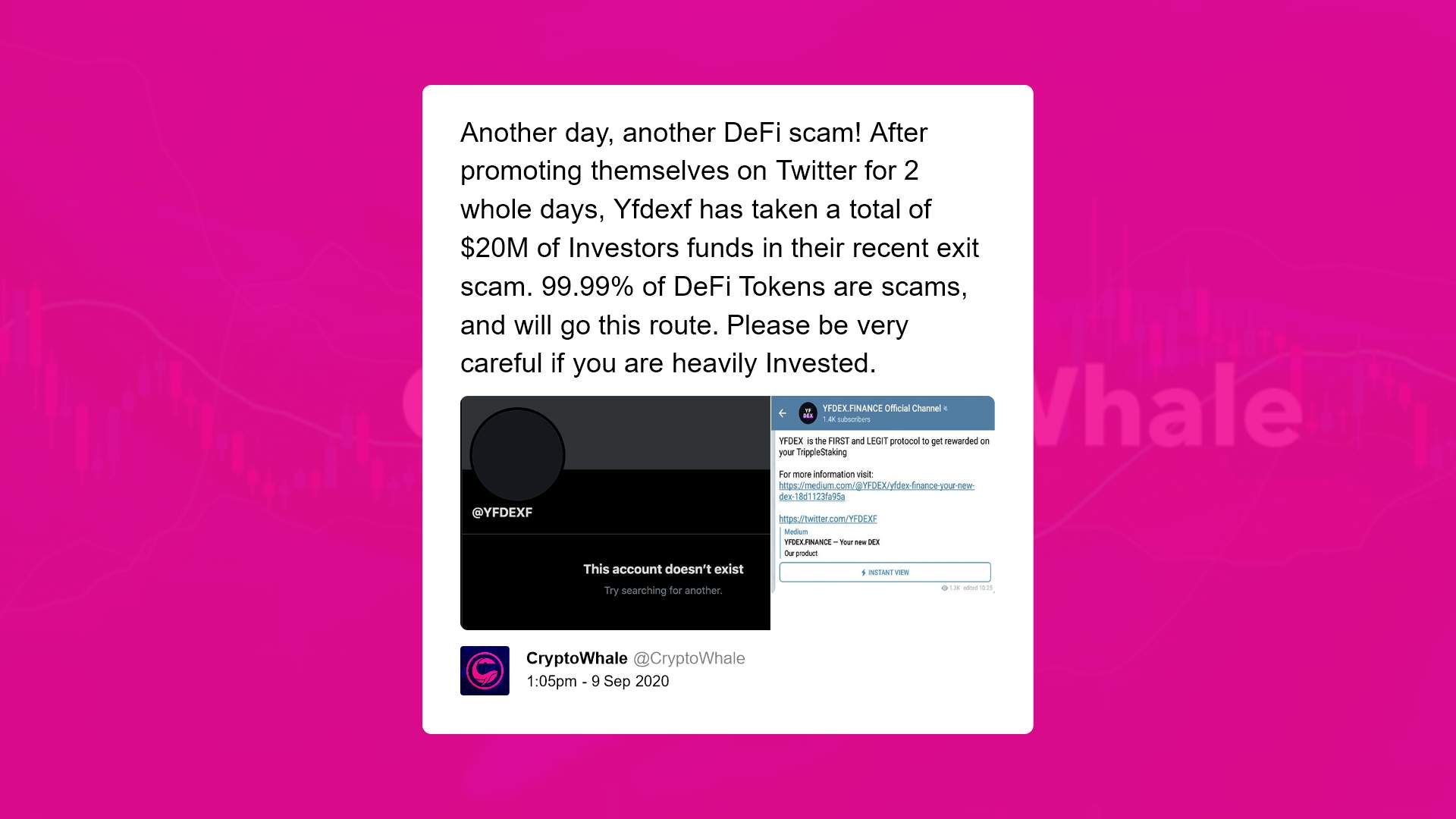

A recent example of this was YFDEX Finance, which burst onto the scene at the start of September. Shills touted it as a new, revolutionary liquidity mining pool, which also featured “TrippleStaking technology.”

Following aggressive promotion on Twitter, Telegram, and Medium, the promoters disappeared with $20 million of investors’ cash.

@CryptoWhale took the opportunity to warn investors that 99.99% of DeFi projects are scams.

Source: twitter.com

When called out on his exaggeration of 99.99% of DeFi projects being scams, @CryptoWhale held firm by saying:

“It’s not an exaggeration. There’s thousands of DeFi projects, and I can’t even think of 5 that aren’t scams.“

Taking this into consideration, according to @CryptoWhale, DeFi is much worse, in terms of scams, than ICOs ever were.

Decentralized Finance is “Real” Unlike ICO Chancers

Despite the continuing scam narrative, Cameron Winklevoss, Co-Founder of Gemini exchange, supports the decentralized finance cause.

In a recent tweet, Winklevoss stated that DeFi “is real,” not like the ICO fad of 2017, which he sums up as chancers having a go with nothing more than a whitepaper.

Expanding on his point, Winklevoss didn’t mention the scams prevalent in both phenomena. Instead, he chooses to focus on the legit DeFi projects, saying they are up and running and generating billions of dollars in positive yield.

DeFi is not the same as the 2017 ICO craze. Back then, money was raised on shitcoin white papers written in a coffee shops. DeFi is already live and working in the wild. Billions of dollars are at work earning positive yield. This isn’t hypothetical vaporware, this is real.

— Cameron Winklevoss (@cameron) September 22, 2020

For Winklevoss, he believes that DeFi has longevity, which is what differentiates it from ICOs. However, this is still a view that divides opinion.

Ethereum Rivals Cannot Capitalize on DeFi

Clem Chambers, CEO of ADVFN.com, has a mixed response towards DeFi. The sticking point for him, as well as for other users, lies in the high gas fees to execute contracts.

“Right now, at these costs, DeFi is a non-starter. I’m not going to place a bet on Donald Trump losing the election if it costs me $80 in fees. Is anyone? I don’t think so.”

In particular, he talks about this fostering a situation where it’s only worth it for investors with upwards of tens of thousands of dollars to spend.

But then again, Chambers raises the point that he doesn’t trust DeFi enough to drop these sorts of sums into the ecosystem.

Of course, this is a situation that hasn’t gone unnoticed. Various solutions are in development that could ensure DeFi’s longevity. These points primarily consist of changes to the Ethereum ecosystem.

But most interesting of all is the shift to other blockchains. However, rival projects have failed to capitalize on this in any sort of meaningful way.