In the countdown to the Shelley mainnet launch at the end of this month, Cardano has released details of its staking reward system.

The amount of staking reward is determined by several factors, such as the number of staking pools in operation, the saturation of a delegated pool, and block production efficiency. At present, all elements are undetermined.

However, based on the default estimates of IOHK, users will receive 4.6% per annum.

Rewards from the Incentivized Testnet (ITN) were between 6% – 8%, depending on individual testnet staking pools. As such, news of a sub-five reward on mainnet is something of a blow for ADA holders.

In response to the announcement, one user wrote:

“Most people were predicting 6-10% and even Charles said in one of his AMAs it would be similar to the ITN. I’m happy with 6% but under 5.. better to sell and buy property.“

Another pointed out that the figure is notional; what’s more, 4.6% is still a better rate than any bank is currently offering.

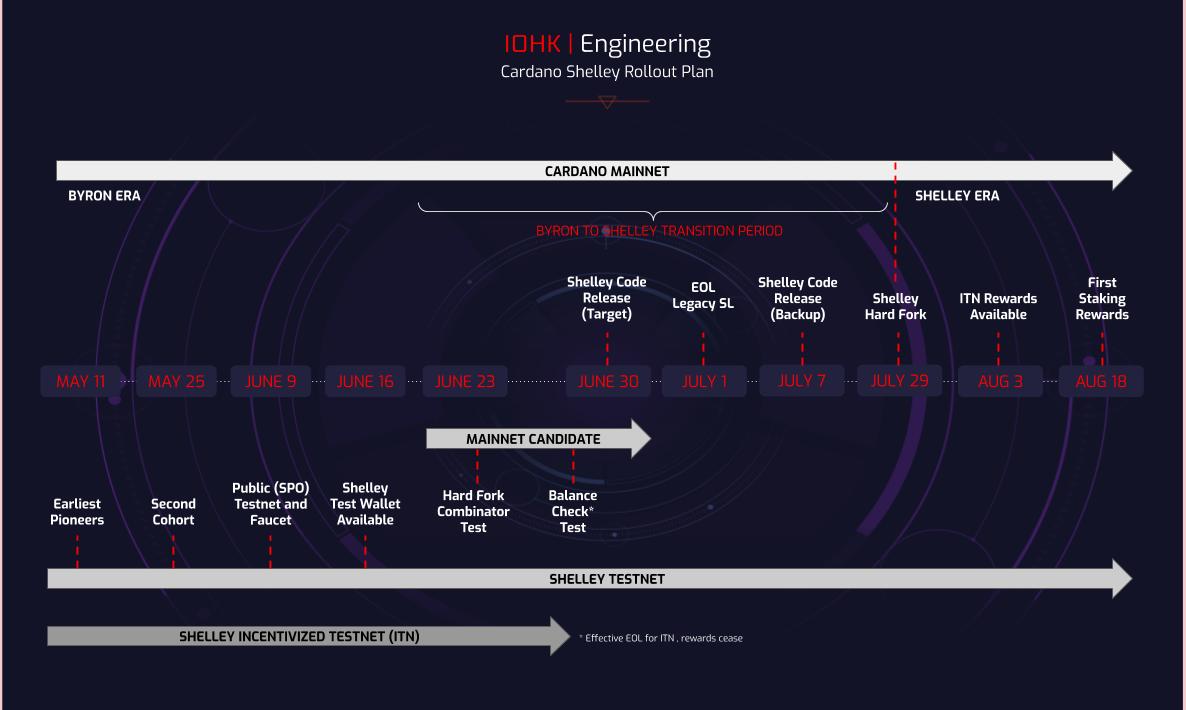

Cardano staking rewards go live from August 18th, 2020, three weeks after the rollout of Shelley.

Source: twitter.com

Cardano Staking Walkthrough

Dr. Lars Brünjes, the Education Director at IOHK, gave an overview of the Cardano staking process, as well as a walkthrough of the staking calculator.

“How are rewards calculated? That happens on an epoch by epoch base. Every epoch, which lasts for five days, rewards are determined and paid to all participants.”

Each stake pool receives a reward determined by factors such as the ADA pledge of the pool, the margin operational costs of the pool, performance in terms of block production efficiency, and the amount staked with the pool.

After all the costs are subtracted, the remaining balance is split proportionally between all delegators.

Brünjes also spoke about the diminishing returns on pool saturation, this process lowers the reward payout if a pool becomes too big. This is currently set at around 0.66%. If a pool controls more than this of the entire stake, then rewards paid to that pool are reduced.

The idea is to incentivize stakers to move funds to smaller pools, in the hunt for better payouts, which also encourages greater decentralization of the network.

Brünjes mentioned that discussions with the community will take place after staking goes live. That way, feedback to change the system parameters can be made.

How Does Cardano Fare Against Other Staking Protocols?

The Cardano community as a whole has reacted unfavorably towards the estimated staking returns.

While the 4.6% figure is based on indeterminate factors at present, it’s still much lower than rewards from other staking protocols.

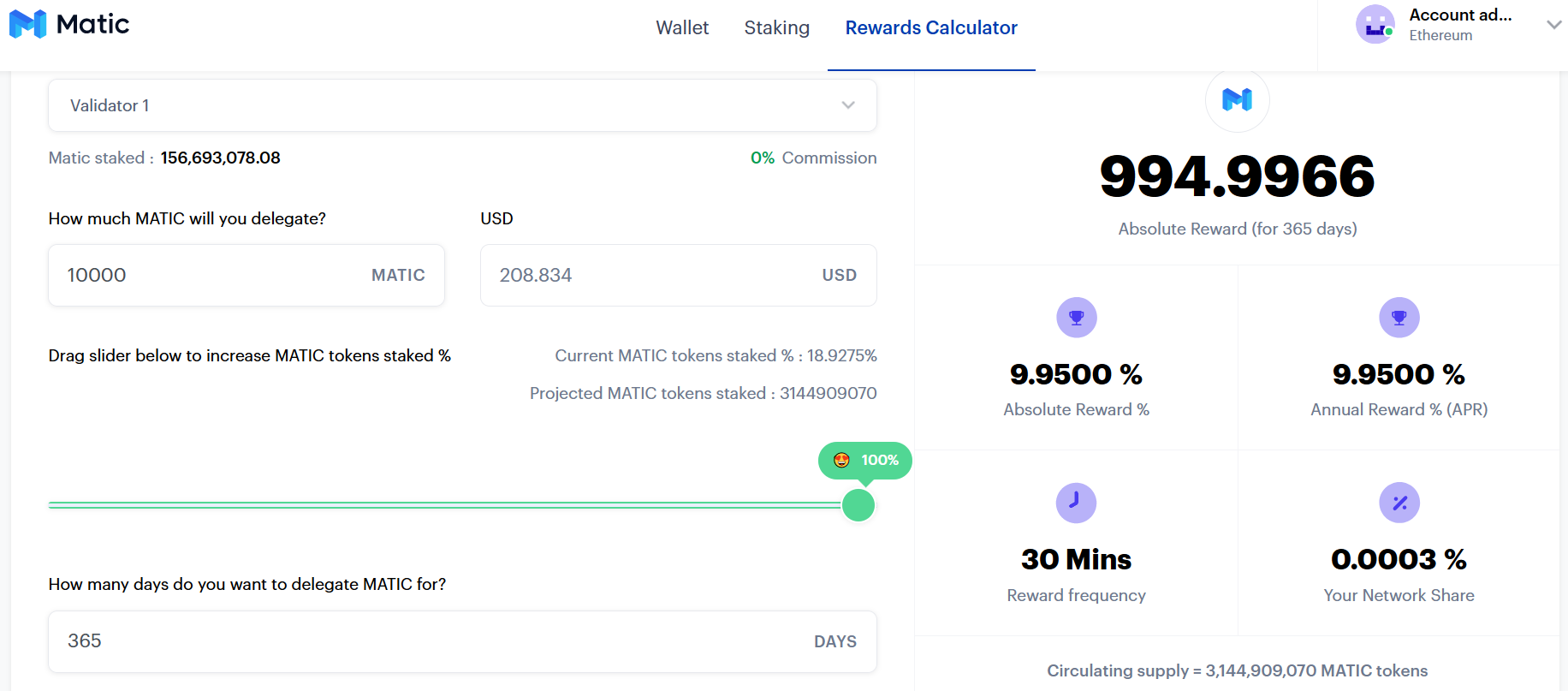

Matic Network currently pays 53%, based on 18% of Matic staked. This amount will fall as more Matic is staked, but even with 100% of circulating supply staked, the Matic protocol will pay 9.95%.

Source: wallet.matic.network

Tezos is more comparable with Cardano in terms of having similar market cap and volume. Data shows Tezos currently pay a staking reward of 5.48%.

As such, while the Cardano community may be disappointed, the reward level is still in line with expectations.

car