The electric car manufacturer Tesla is proving to be yet another Bitcoin (BTC) HODLer. Their Q3 2023 earnings report indicates that Elon Musk’s automotive company held onto its coins, not liquidating coins over the last few quarters.

Tesla Holding On To Bitcoin

Although Tesla has not bought any Bitcoin since February 2021, even selling 75% of its holdings in April 2022 at a loss, the technology firm has chosen not to sell despite recent market gyrations. By November 2021, prices soared to over $69,000 but fell months later to $16,000 in 2022.

In February 2021, Tesla bought $1.5 billion of Bitcoin, acquiring around 43,000 BTC. Around the same time, the automaker said it would accept the coin for payment before reneging on its comments weeks later.

It should be noted that Tesla’s report didn’t mention Bitcoin in their Q3 2023 report. Therefore, it is doubtful that the company made any changes, additions, or liquidation of their coins. However, it is unclear how much Bitcoin the company holds as of press time. According to the last earning reports of Q2 2023, Tesla held around $184 million of the coin. The exact figure also fluctuates, considering the volatile nature of crypto assets.

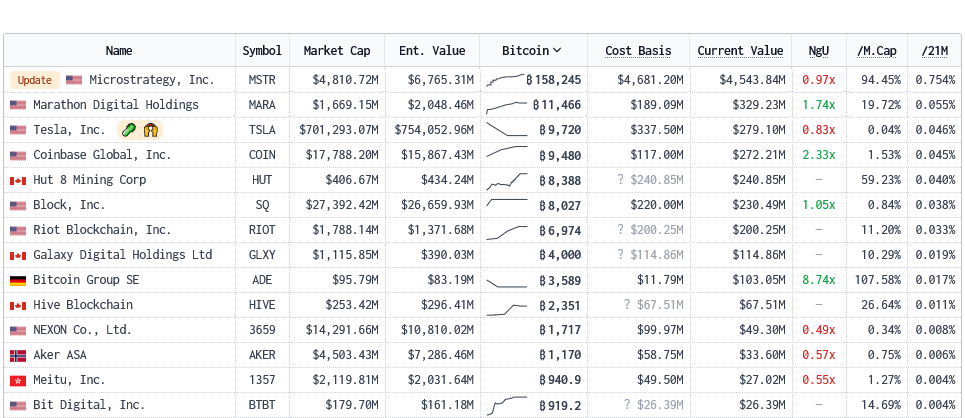

Even so, parallel Bitcoin Treasuries data shows that Tesla is among the biggest holders of the coin. With 9,720 BTC worth over $277 million at current prices, the company is the third largest public firm after MicroStrategy, a business intelligence firm; and Mara Digital, a Bitcoin miner. MicroStrategy has been accumulating Bitcoin, buying more coins in 2022 when prices crashed to around $16,000.

Other notable public companies and coin holders include Coinbase, the crypto exchange operator; Riot Blockchain– a miner; and Galaxy Digital, a crypto venture capital. Another public firm, Meitu, holds Bitcoin and Ethereum (ETH). However, it recently declared its intention to sell and refocus its efforts on artificial intelligence.

Crypto Disclosures And The SEC

As a public company, Tesla is legally obligated to disclose its finances to the Securities and Exchange Commission (SEC), the primary regulator in the United States. This means that the company must also make public all material information to its investors, including its financial health, the status of its operations, and the risks it could face.

This disclosure of crypto holdings seems to be the standard despite the agency not mandating public companies to do so. Even so, the regulator only requires firms it oversees to disclose information they consider necessary to investors. In publicly disclosing their BTC holdings, Tesla makes known the financial impact their coins have.

Source: https://bitcoinist.com/tesla-electric-car-maker-bitcoin-buy-more-btc/