Project Mariana, an initiative whose goal was to explore the application of central bank digital currencies (CBDCs) in enhancing the efficiency and security of cross-border payments, has been successfully concluded, the Bank of France has confirmed.

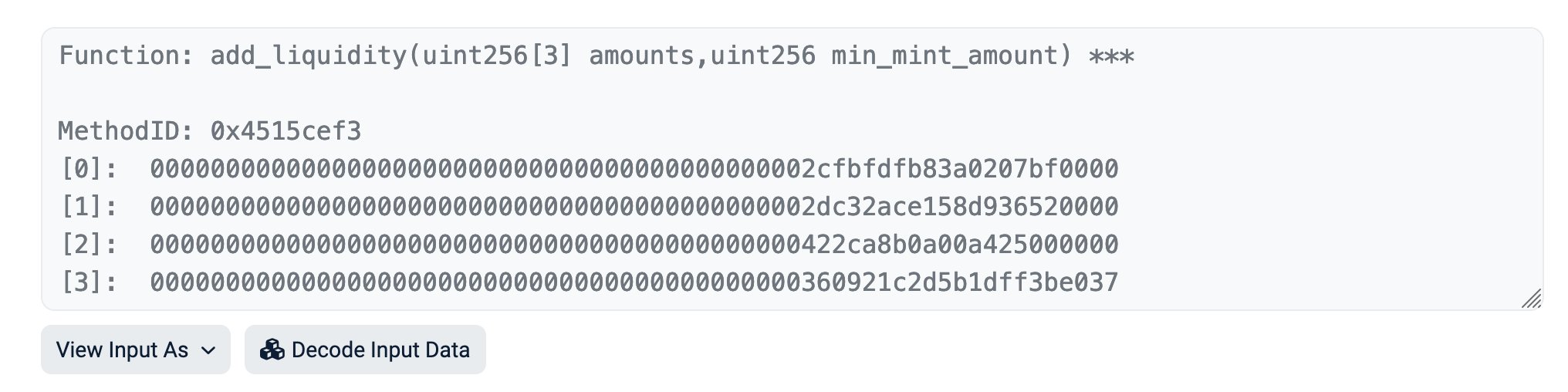

Even as this pilot comes to an end, one developer notes that the Bank of International Settlements (BIS) reportedly utilized the public Ethereum Sepolia testnet and Curve Finance’s smart contracts as the base of Project Mariana, testing and measuring the efficacy of cross-border Forex automated market maker (AMM) pilot.

The CBDC project depended on Curve Finance’s code. Even so, the BIS wanted to keep the use of Curve’s framework private. So far, there has been no comment from Curve Finance or any Ethereum core developers regarding Project Mariana’s use of decentralized finance (DeFi) code or architecture.

However, looking at Curve Finance’s experience in enabling stablecoin movement and swapping, their expertise could have been valuable. DeFiLlama data on September 28 shows that Curve Finance had over $2.1 billion in total value locked (TVL).

Curve Finance is a decentralized exchange (DEX) for trading stablecoins, tokenized fiat, issued privately by entities such as Circle or Tether Holdings. The protocol depends on an automated market maker (AMM) model to draw liquidity and ensure price discovery at low slippage.

Project Mariana, a platform by the BIS and multiple central banks such as the Bank of France and the Swiss National Bank, used the same architecture for the same goals as in Curve Finance: access liquidity and achieve price discovery.

It is unclear which versions of Vyper were used to code the smart contracts in this pilot. However, it is worth noting that Curve Finance experienced a hack in late July, resulting in over $60 million loss. This happened due to a vulnerability in older versions of Vyper that was exploited through a re-entrancy attack.

Anti-CBDC Bill Supported By Republicans In The United States

While the BIS says central banks should first create a CBDC framework, the anti-CBDC bill, or the CBDC Anti-Surveillance State Act, introduced by pro-crypto Congressman Tom Emmer in February 2023, was recently considered by the House Financial Services Committee on September 20, 2023. The bill is yet to be voted by the full House of Representatives.

If adopted, the act will bar the Federal Reserve, the US central bank, from issuing a digital version of the dollar. The bill is widely supported by Republicans and opposed by Democrats. Supporters are concerned about abuse, claiming that CBDCs give “governments more power and infringe on privacy rights.”

Source: https://bitcoinist.com/bis-ethereum-testnet-curve-code-test-pilot/