Is the Bitcoin mining network decentralized enough? Or do the big miners control a significant part of it? Here’s what the latest data says.

Public Bitcoin Miners Control Around 28% Of The Total Hashrate

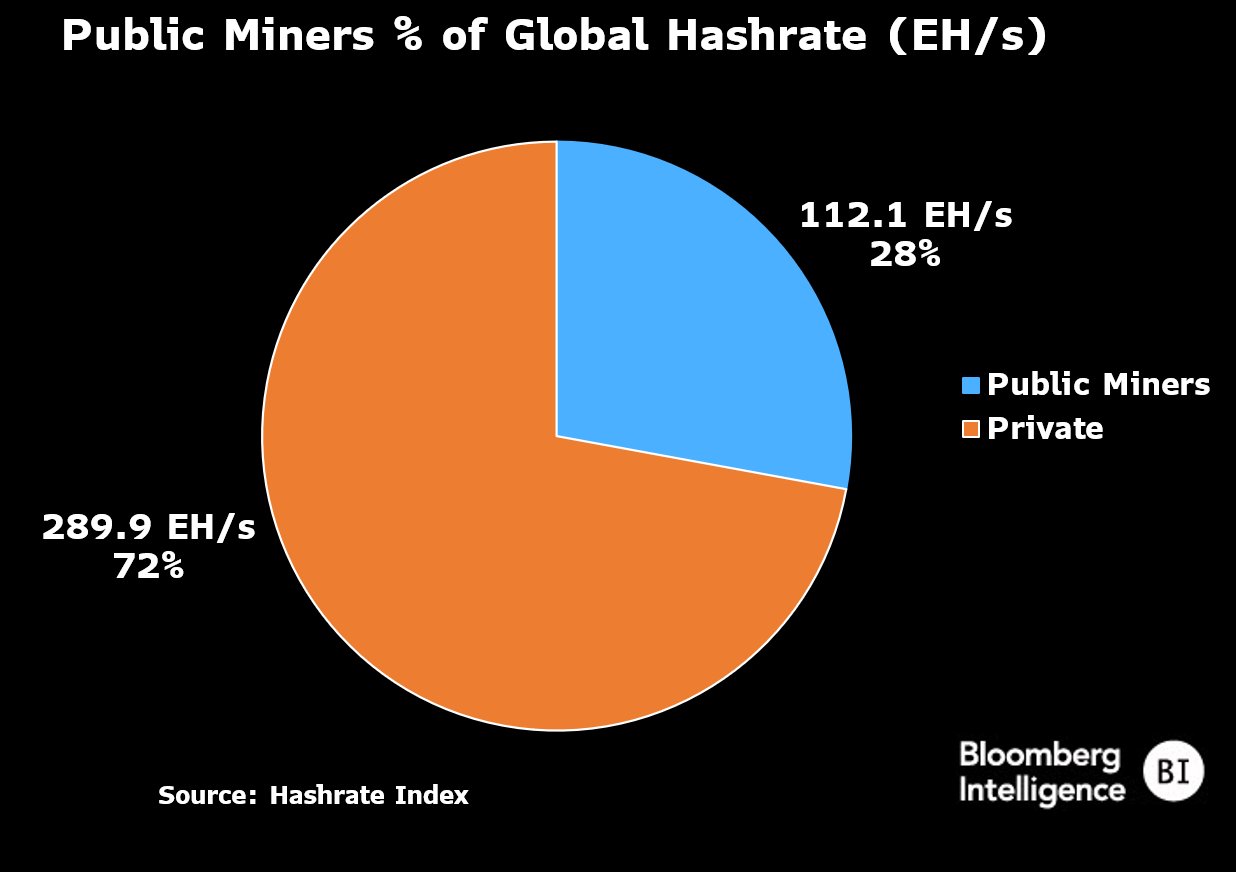

In a new post on X, Bloomberg Intelligence market analyst Jamie Coutts discussed how the mining industry has evolved. The first thing Coutts talked about is what the share of the global Bitcoin hashrate is looking like between private and public miners.

The “hashrate” here refers to the total computing power the miners have connected to the Bitcoin network. This metric can serve as a measure of the security of the blockchain, as more mining rigs being attached means a 51% hack is harder to perform.

The security also depends, however, on how decentralized the hashrate is. A large amount of it being controlled by a single entity could make it easier to access all that hashrate, at least on paper.

Now, here is the chart that the CMT has shared that breaks down the hashrate contributions of public and private miners connected to the BTC blockchain:

As displayed above, 28% of the total Bitcoin hashrate is owned by public miners, while the rest is under the control of private entities. While public companies control a notable segment of the hashrate, it’s not alarming (at least not yet).

The fact that 72% of the hashrate is private does deal a blow to the FUD narrative that spreads around about the BTC network being centralized under the big public entities.

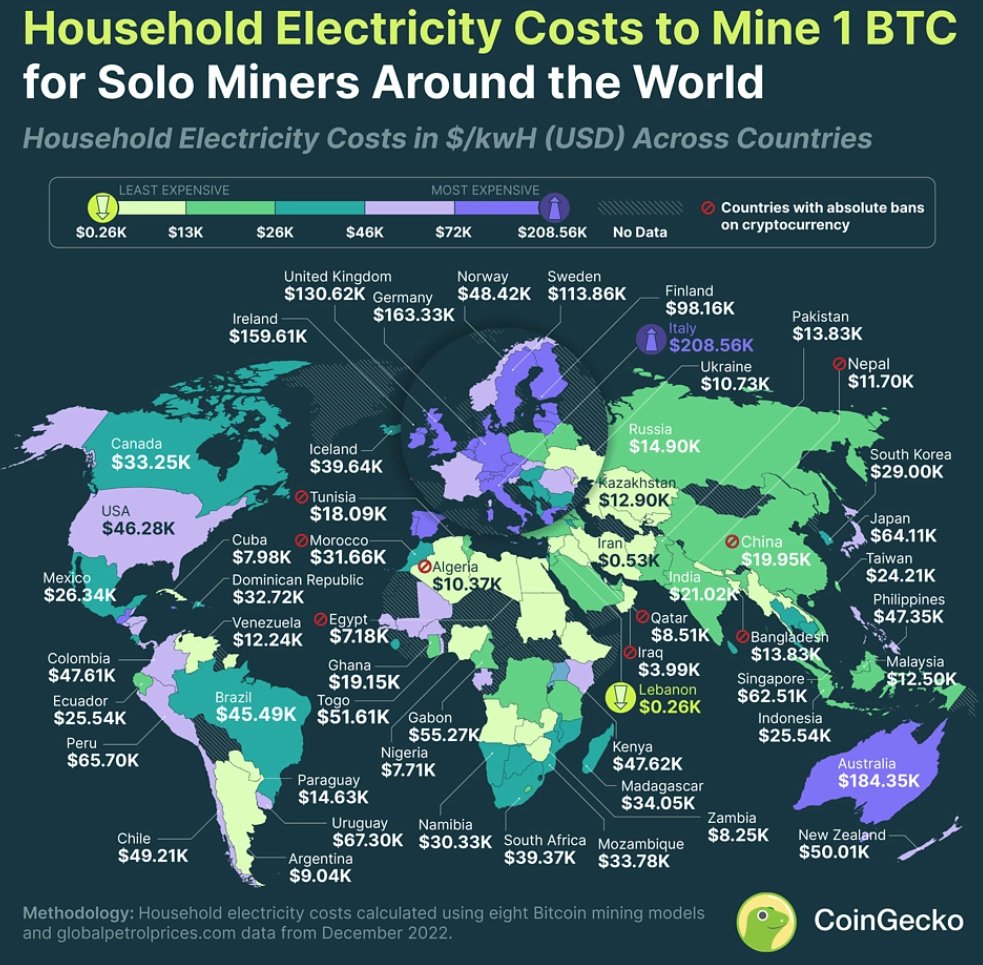

“Small-scale miners remain critical to keeping the industry decentralized and more anti-fragile,” explains Coutts. “But for some countries, mining is outlawed or economically unfeasible.”

Below is a chart from a recent CoinGecko report that shows how much the electricity costs to mine 1 BTC in different countries worldwide.

The analyst notes that the Western nations leading the charge towards a transition to clean energy have some of the most expensive electricity. Thus, the solo miners in these countries are effectively priced out of mining the cryptocurrency.

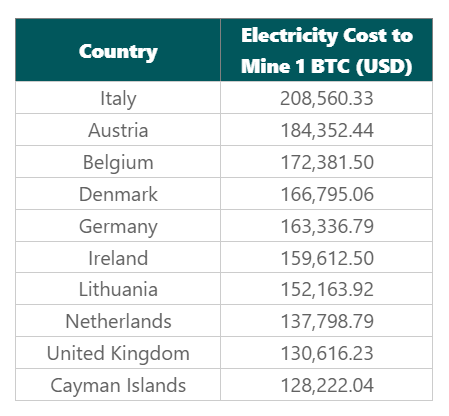

Here is a table that displays the top 10 most expensive nations in this metric in a more easy-to-digest format:

For the top nation on this list, which is Italy, a miner would end up incurring an electricity cost of $208,560 to mine just one token of the digital asset. The value of Bitcoin would need to rise multiple times over for the miner to break even.

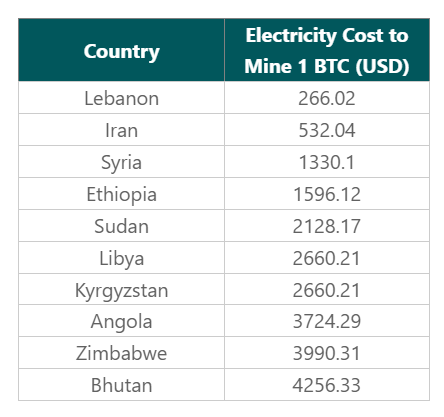

On the contrary, some smaller nations have quite cheap electricity costs, as the table below shows.

“But even where electricity prices are dirt cheap, there are risks of overloading fragile energy grids,” says the Bloomberg Intelligence analyst. “Not to mention, these countries are some of the most politically unstable on earth.”

BTC Price

Bitcoin had made a sharp move towards the $26,800 level earlier in the day, but it would appear that the recovery move has failed, as the asset has already returned to under $26,300.

Source: https://bitcoinist.com/bitcoin-network-decentralized-what-the-data-says/