BTC price volatility returns as good news over GBTC’s conversion to a spot Bitcoin ETF sends markets rallying.

The Bitcoin (BTC) price soared to near two-week highs on August 29, following the announcement that digital asset manager Grayscale had won a lawsuit against United States regulators. This news brought back volatility to the BTC market, which had been relatively stagnant since experiencing losses in mid-August. The price of BTC/USD surged by $1,700 in just 30 minutes after the news broke, signaling a significant positive reaction from investors.

SEC was “arbitrary and capricious” with Bitcoin ETF rejection

The United States Court of Appeals for the District of Columbia Circuit ruled that the U.S. Securities and Exchange Commission (SEC) was wrong in rejecting Grayscale’s application to launch an exchange-traded fund (ETF) based on the Bitcoin spot price. The court’s ruling stated that the SEC’s denial of Grayscale’s proposal was “arbitrary and capricious” because the SEC failed to provide a sufficient explanation for its different treatment of similar products. This decision by the court highlights the importance of transparency and fairness in regulatory processes, and it has significant implications for the future of Bitcoin ETFs in the U.S.

Ruling by the United States Court of Appeals for the District of Columbia Circuit

The ruling by the United States Court of Appeals for the District of Columbia Circuit has set a groundbreaking precedent for the regulation of Bitcoin ETFs in the country. The court’s decision to overturn the SEC’s rejection of Grayscale’s ETF application sends a clear message that regulatory agencies must provide valid and consistent reasons for their actions. This ruling may pave the way for other firms to pursue the launch of Bitcoin ETFs, as it challenges the SEC’s authority to deny such applications without justification.

Grayscale joins waiting list for spot Bitcoin ETF

Grayscale’s victory in the legal battle against the SEC has positioned the company to join the list of firms seeking to launch the first spot Bitcoin ETF in the U.S. While the SEC is yet to approve any application for a Bitcoin ETF, the court’s ruling in favor of Grayscale provides hope for other firms looking to enter the market. A spot Bitcoin ETF would provide investors with a regulated and secure way to gain exposure to Bitcoin, potentially attracting more institutional and retail investors to the crypto market.

BTC/USD reaches as high as $27,723 on Bitstamp

Following the announcement of Grayscale’s win, the price of BTC/USD reached as high as $27,723 on the Bitstamp exchange. This surge in price indicates a strong positive sentiment among investors and suggests that the market sees the court’s ruling as a significant step towards the legitimization of Bitcoin and the wider cryptocurrency industry. However, it is important to note that the BTC market is highly volatile, and prices can fluctuate rapidly in response to various factors.

Thin liquidity in BTC/USD order book

Despite the increase in BTC price, there is concern about the thin liquidity in the BTC/USD order book. This means that there is a lack of depth in the market, making it easier for large orders to significantly impact the price. While this may present opportunities for traders to exploit price movements, it also introduces the risk of market manipulation and volatility. Traders and investors should exercise caution and be aware of the potential risks associated with trading in thinly liquid markets.

Grayscale decision could impact existing ETF applications

The court’s ruling in favor of Grayscale could have significant implications for existing Bitcoin ETF applications, including that of BlackRock, the world’s largest asset manager. The decision sets a precedent that challenges the SEC’s authority to reject similar ETF applications without a valid explanation. This could lead to increased scrutiny and pressure on the SEC to provide more clarity and consistency in its decision-making process. If other ETF applications receive favorable rulings based on the court’s decision, it could pave the way for the widespread adoption of Bitcoin ETFs in the U.S.

CEO Michael Sonnenshein expresses gratitude following setback

Following the setback of the SEC’s rejection of Grayscale’s ETF application, CEO Michael Sonnenshein expressed his gratitude to investors and supporters who have been on this journey with the company. He emphasized the firm’s commitment to continuing the pursuit of converting its existing Bitcoin investment vehicle, the Grayscale Bitcoin Trust (GBTC), into an ETF. Sonnenshein’s statement reflects the determination and resilience of Grayscale in its mission to provide innovative investment products in the crypto market.

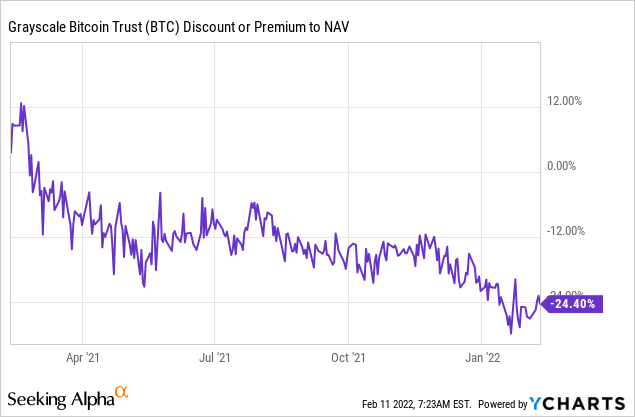

GBTC share price increases by over 17%

In response to the court’s ruling and the positive market sentiment, the share price of Grayscale Bitcoin Trust (GBTC) increased by over 17% at the time of writing. This significant surge in the GBTC share price indicates a strong demand for the product and suggests that investors see the conversion of GBTC to an ETF as a positive development. However, it is important to note that past performance is not indicative of future results, and investors should carefully consider their investment objectives and risk tolerance before making any investment decisions.

Investment advice disclaimer

This article serves as a news update and does not contain investment advice or recommendations. investing in cryptocurrencies, including Bitcoin, involves risks, and readers should conduct their own research and consult with a financial advisor before making any investment decisions. The information provided in this article is for informational purposes only and should not be relied upon as financial, legal, or tax advice. The volatile nature of cryptocurrencies can result in substantial losses, and investors should be prepared for the possibility of losing their entire investment.