Data shows the current Bitcoin cycle is the first one in the history of the cryptocurrency to deviate from an established pattern of transaction fees.

The Latest Bitcoin Cycle Has Seen Less Cumulative Fees Than The Previous One

According to data from the on-chain analytics firm Glassnode, the cryptocurrency has seen cumulative fees of just 53,800 BTC since the last halving. The “halving” here refers to a periodic event where the block rewards (that is, the rewards that the miners receive for solving blocks on the network) are permanently cut in half.

The halvings are always quite significant for Bitcoin as the block rewards are the only way new BTC is produced/minted, so their being halved tightens the production of the asset.

The narrative associated with halvings also carries quite the punch, as bull markets have historically followed them. Halvings take place approximately every four years.

Given their periodicity and importance in the market, the halvings have emerged as a popular way to define the start and end points of what constitutes a Bitcoin cycle or “epoch.”

In the context of the current discussion, the various cycles of the cryptocurrency have been compared on the basis of the cumulative transaction fees that they have observed. The “transaction fees” here are naturally the amount that the miners receive for handling individual transactions.

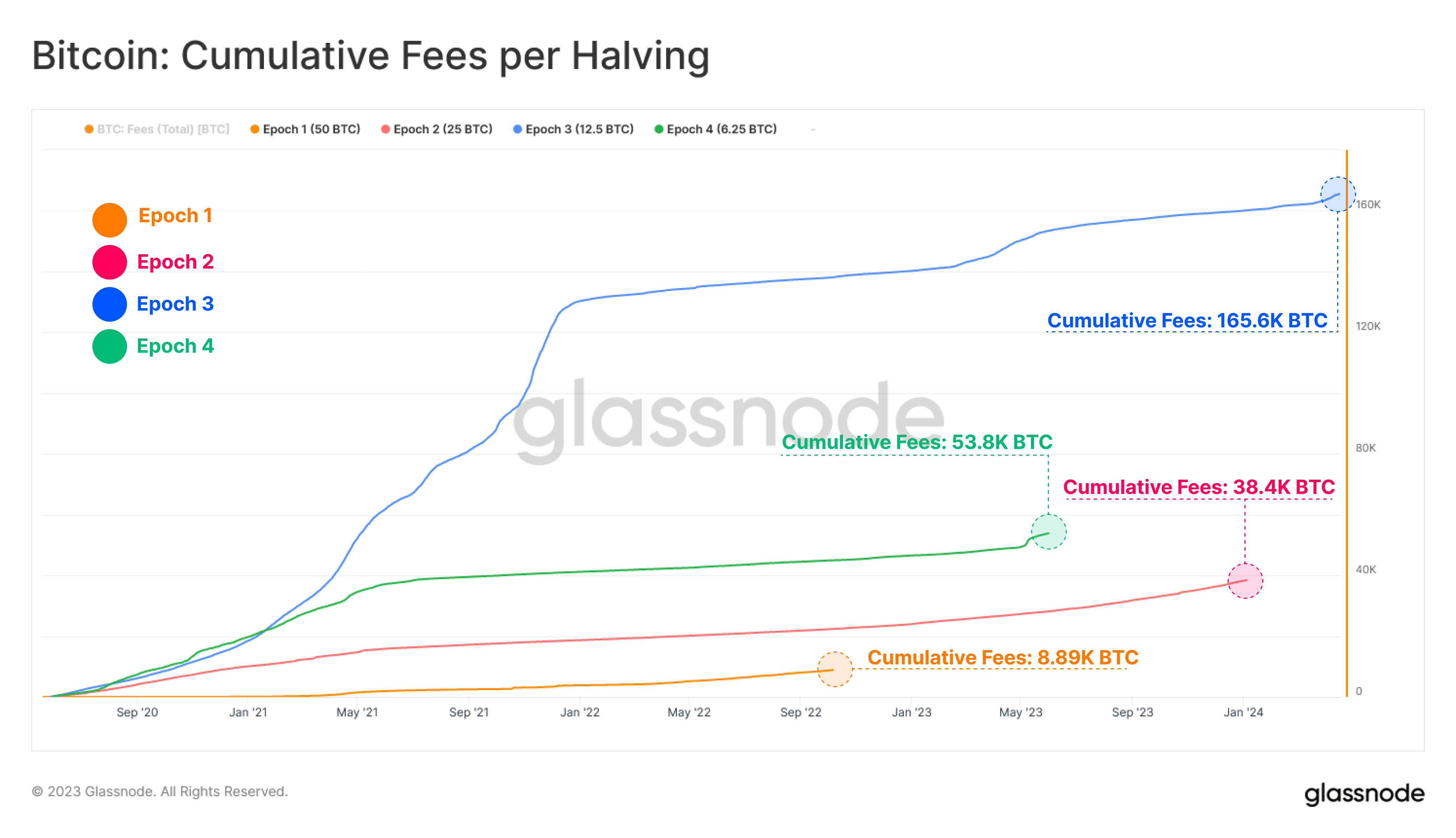

Now, here is a chart that shows the trend in the cumulative fees for each of the previous epochs, as well as for the current cycle so far:

As you can see in the above graph, the very first Bitcoin cycle saw the miners receive a total amount of 8,890 BTC in transaction fees. The second epoch then saw this value jump by a few factors, as it registered 38,400 BTC in fees.

The next cycle also followed this pattern, as the cumulative transaction fees once again saw a sharp growth with its value hitting 165,600 BTC. The rise in the cumulative fees throughout these cycles makes sense, as the asset has only become more adopted as the years have gone by, so the demand for the transactions has naturally increased.

However, the latest epoch has deviated from this pattern, as the cumulative amount of fees received by the miners in it so far has only been 53,800 BTC, which is just one-third of that seen in the last cycle.

Obviously, the current epoch isn’t over yet, so theoretically this trend could perhaps change and return to the norm. However, considering that the upcoming halving is just next year, it would appear highly unlikely that the cumulative fees can close the current large gap.

As for the reason for this divergence, Glassnode explains, “This drop in fees is mainly driven by improvements in transactional efficiency such as SegWit and Transaction Batching, largely adopted across our current Epoch.”

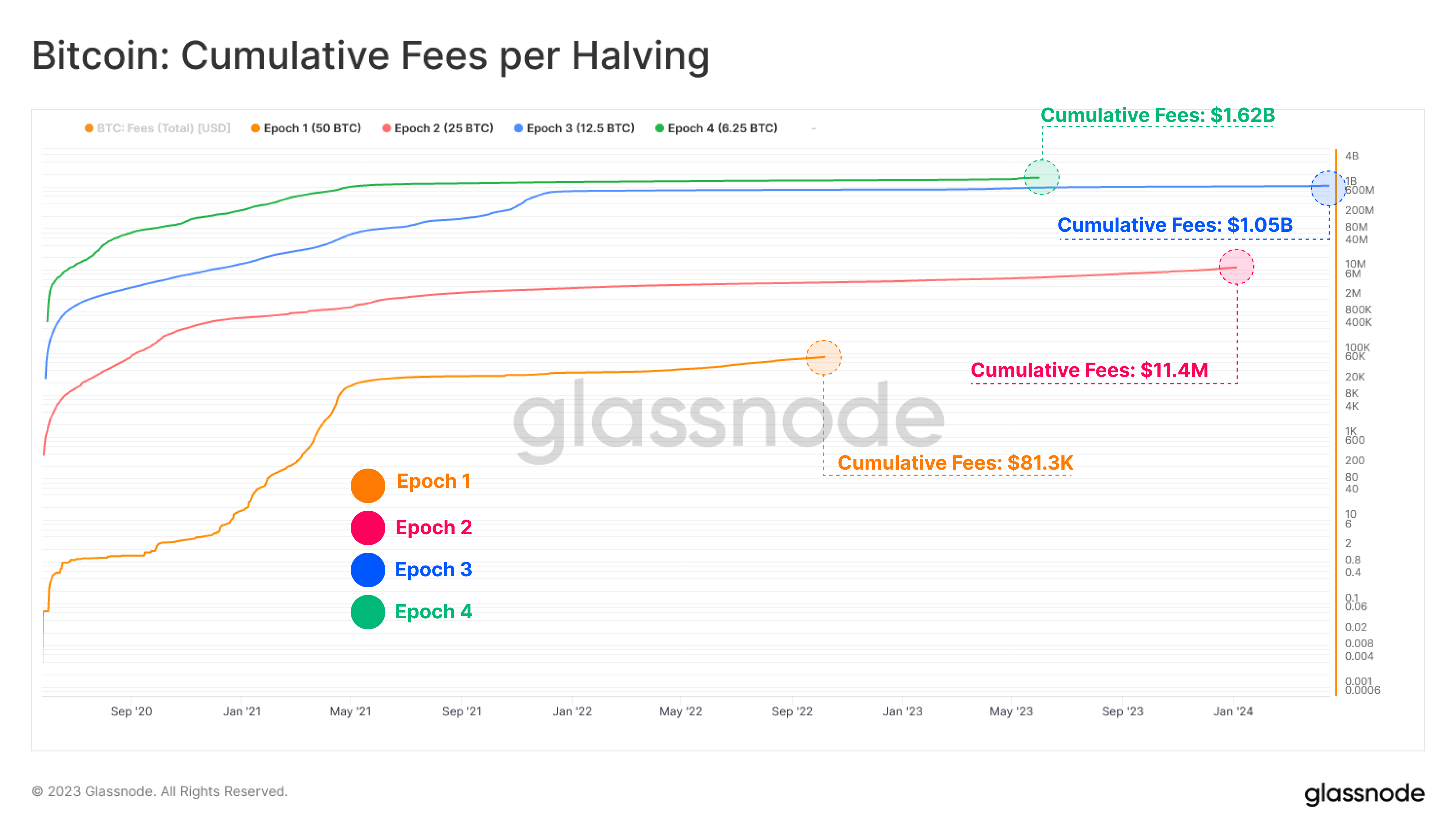

In terms of the USD value of the transaction fees, though, the pattern is still being maintained, as the current cycle’s cumulative fees have been worth $1.62 billion, more than any other epoch.

BTC Price

At the time of writing, Bitcoin is Trading around $27,100, up 2% in the last week.

Source: https://bitcoinist.com/current-bitcoin-cycle-broken-fee-pattern-first-time/