Here’s the on-chain indicator that may have foreshadowed the recent dip in the price of Ethereum below the $1,800 level.

Ethereum Has Plunged After Multi-Collateral Dai Repaid Metric Spikes

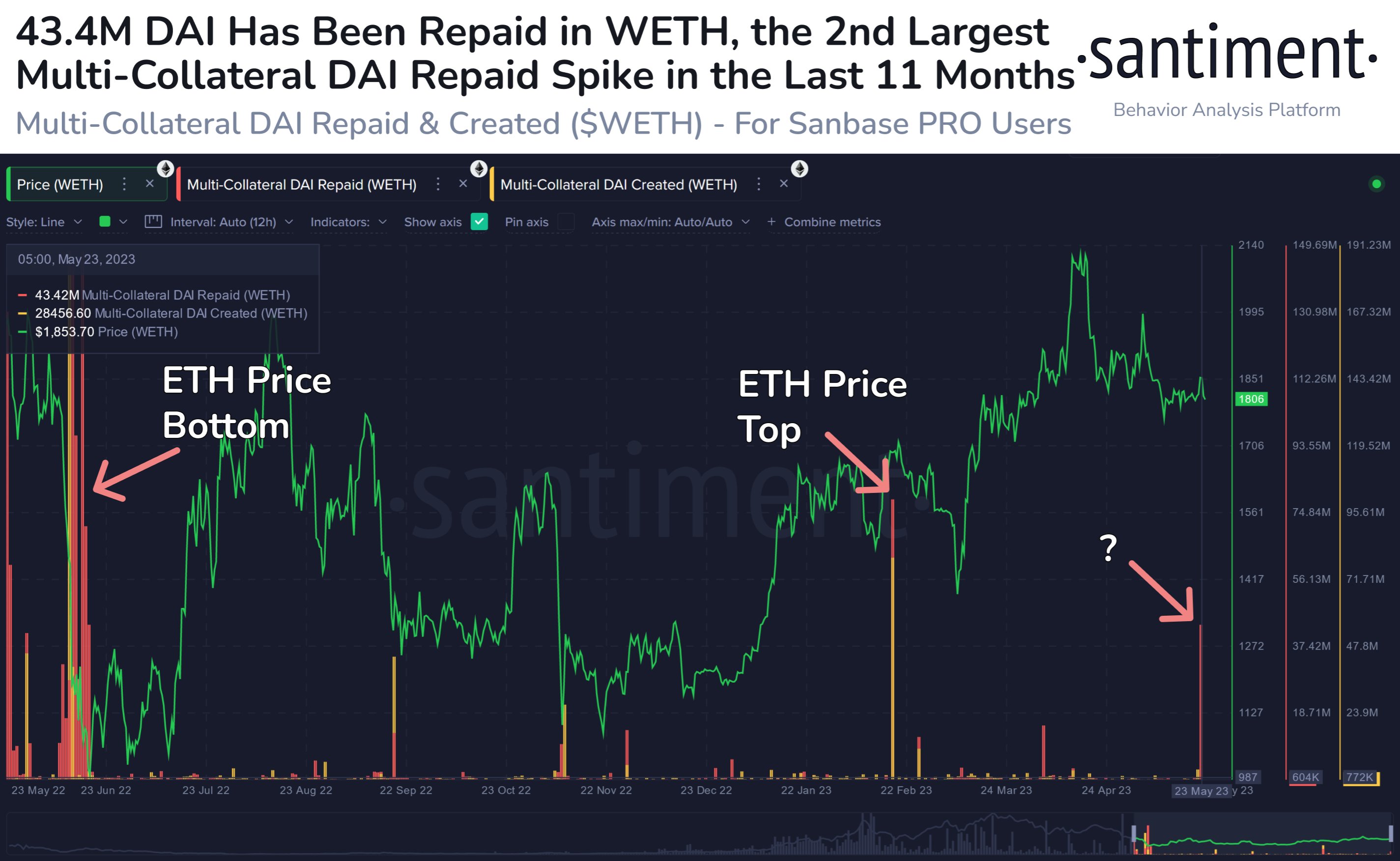

According to data from the on-chain analytics firm Santiment, 43.4 million Dai was repaid in Wrapped ETH (WETH) during the past day. Multi-Collateral Dai (DAI) is a decentralized stablecoin built on the Ethereum blockchain that’s soft pegged to the US Dollar, meaning that its value remains fixed at $1.

The coin is called multi-collateral because it is backed by a mix of cryptocurrencies. An earlier version of the coin was Single-Collateral Dai (SAI), and it was only backed by one asset.

When Dai is minted (that is, new coins enter into circulation), users have to deposit their collateral into the smart contract vaults. In the context of the current discussion, the stablecoin tokens minted using WETH as collateral are of interest.

The “Multi-Collateral DAI created” is an indicator that measures the total amount of coins of the stablecoin that are being minted using WETH right now. The counterpart metric of this indicator is the “Multi-Collateral DAI repaid,” which naturally tracks the instances of WETH being returned after the issued tokens are destroyed.

Here is a chart that shows the trend in these two Wrapped Ethereum indicators over the past year:

As you can see in the above graph, Santiment has highlighted an interesting pattern that the Ethereum price has followed in response to spikes in the Multi-Collateral Dai repaid indicator.

It looks like whenever a large amount of Dai has been destroyed to release WETH, the price of the cryptocurrency has registered either a top or a bottom. In the past year, there have been two instances of this trend.

The first of them took place almost one year ago, right after the ETH price crashed due to the 3AC bankruptcy. This spike coincided with the bottom formation of the cryptocurrency.

The other one was earlier in February of this year and unlike the first one, this spike coincided with the asset forming a local top.

Recently, the indicator has once again observed a large spike, meaning that someone has withdrawn a large amount of the wrapped form of Ethereum that was previously being used to back Dai tokens.

In total, 43.4 million DAI has been destroyed with this latest spike. This is the third largest that the indicator’s value has been during the past 12 months and only the aforementioned instances of the metric registered withdrawals of larger scales.

If the pattern of the previous spikes holds any weight at all, then the current Dai WETH repayments may also lead to Ethereum observing either a local top or a local bottom.

Yesterday, Ethereum plunged below the $1,800 level, so perhaps the decline was due to the indicator’s spike. Today, however, the cryptocurrency has already rebounded back above this level, so it’s hard to say whether the metric’s influence is already done with, or if the real effect is yet to come.

ETH Price

At the time of writing, Ethereum is trading around $1,800, down 1% in the last week.

Source: https://bitcoinist.com/this-metric-signaled-ethereum-dip-1800-in-advance/