Bitcoin price and its explosive ascent to the top of the cryptocurrency world has been nothing short of breathtaking. But now, as the alpha coin struggles to break through the crucial resistance zone of $30,000, investors are starting to wonder: has Bitcoin’s explosive rally finally run out of steam?

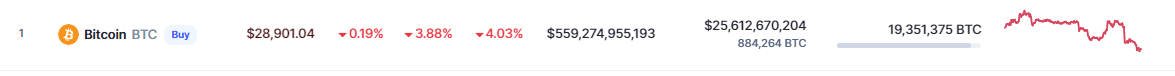

At the time of writing, the soaring trajectory of Bitcoin’s price took a sudden nosedive over the past 24 hours, with the cryptocurrency’s value plummeting by 3.88.% to a disappointing $29,901 according to CoinMarketCap.

Adding to its woes, Bitcoin also experienced a seven-day slump of 4.03%, causing investors to question whether the digital asset’s once-meteoric rise has come to a screeching halt.

Why Bitcoin Price Is Down Today

Bitcoin’s anticipated bull market has come to a halt, as the cryptocurrency market experiences a downward trend triggered by a mix of regulatory ambiguity and a weakening macroeconomic climate.

This negative turn was exacerbated on April 18, as Gary Genseler, the SEC Chair, testified before the United States House Financial Services Committee, leaving crypto traders feeling uncertain and apprehensive.

Related Reading: Dogecoin Blasts Off With 14% Climb Ahead Of Maiden Starship Launch

Investors were particularly concerned by Gensler’s reluctance to clarify whether Ethereum was a commodity or a security, despite being asked numerous times to do so by committee members.

This lack of clarity has only added to the growing regulatory uncertainty surrounding cryptocurrencies, casting a cloud of doubt over their future prospects.

BTC Struggles To Break Crucial Resistance Level

After a period of consolidation around the $28,000 mark, Bitcoin price has launched a determined push to break through the crucial resistance level of $30,000. This level is both psychologically and technically significant, and its fate is likely to have a major impact on the short-term direction of the entire cryptocurrency market.

A successful breach of this resistance level could set off a bullish trend that may see Bitcoin climb toward the next significant resistance zone of around $28,500. However, failure to break through may result in a downward trend toward the 50-day moving average at $26,000 or the mid-trendline of the channel at approximately $25,000.

Despite the uncertainty, bullish investors can take heart in the fact that as long as Bitcoin price stays above the 200-day moving average, the overall market trend remains positive.

This crucial indicator is essential in determining the market’s overall bias and provides a glimmer of hope for those who believe in the potential of the crypto to continue its upward trajectory.

-Featured image from Flickr

Source: https://bitcoinist.com/bitcoin-price-backpedals-below-29000/