The latest crackdown on Binance USD (BUSD) is unlikely to cause any “large structural changes” in the crypto market, according to this report.

What BUSD’s Crackdown Means For Wider Crypto Market

A couple of days back, the U.S. Securities and Exchange Commission (SEC) issued a Wells Notice to Paxos for issuing an unregistered security, the stablecoin Binance USD (BUSD). Following the notice, Paxos has made an announcement that the company will stop the issuance of new tokens of the stablecoin from February 21, 2023.

Since BUSD is one of the biggest players in the market (currently sitting at 7th in the largest cryptocurrencies by market cap list), investors have been wondering what impact this debacle might have on the sector. In its latest weekly report, Arcane Research has tackled this exact topic.

According to the firm, the enforcement is mainly aimed at the cryptocurrency exchange Binance, and not the BUSD issuer Paxos itself. This is evident from the fact that Paxos has announced that it will continue to offer BUSD redemptions until at least February 2024, with their own stablecoin USDP being one of the two ways of cashing out (the other being US dollars). “This should give hope to Circle in avoiding a similar fate with its USDC stablecoin,” the report notes.

One change that would possibly appear in the market is in the Bitcoin spot trading volume dominances of the different stablecoin pairs. The below chart shows what the trading shares of USD Tether (USDT) and BUSD look like right now.

From the graph, it’s visible that the Bitcoin spot trading volume dominance of the BUSD pairs has grown from 16% to 27.6% in the past half a year or so. The driving factor behind this development was the fee removal and consolidation of its stablecoin pairs into BUSD by Binance. In this period, USDT took a hit of about 3.5% in its spot market share.

The report believes that the latest fiasco could mean that the trading dominance of the stablecoin has now peaked and USDT may benefit from it a larger share once again.

As for the offshore derivatives market, Arcane Research thinks that the BUSD pairs will likely see sharply declining open interest (which could show up as a rotation into linear USDT perps or inverse perps), but the fact is the pairs already only play a minor role in both the Bitcoin and Ethereum perps open interest.

“This is unlikely to represent a critical large structural change to the market, for now,” says the report. “Enforcement against USDC or the non-U.S. domiciled USDT, could have more dramatic implications, but the focus on BUSD over USDP could suggest that this path is less likely.”

As for the impact on Binance itself, the exchange will likely have to either restructure its stablecoin pairs, since it earlier consolidated all of them (except USDT) into BUSD pairs, or find a new issuer for the stablecoin.

BTC Price

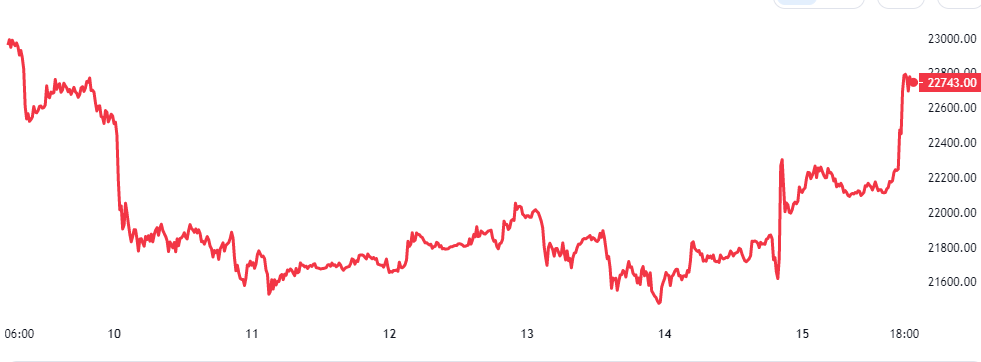

At the time of writing, Bitcoin is trading around $22,700, down 1% in the last week.

Source: https://bitcoinist.com/busd-debacle-large-structural-change-crypto-report/