The Reserve Bank of India (RBI) has launched a pilot program for its new digital currency, the e-Rupi. This will be a digital version of the Indian native currency. RBI’s initiative is to establish an electronic version of cash that can be primarily used for retail transactions. The pilot program launched on Thursday will initially be carried out with three banks, including HDFC, ICICI, and the State Bank of India (SBI). The digital currency will be initially launched in four cities – India’s capital New Delhi, Mumbai, Bhubaneswar, and Bengaluru.

Although this initiative by the Reserve Bank of India was proposed as an alternative to the increasing crypto transaction in the country, the use case of a centralized digital currency is still not fully understood by the users. India already has the Unified Payment Interface (UPI), a real-time payment system that powers multiple bank accounts into a single mobile application. In that case, what is the purpose of this new digital currency?

Understanding the need for a centralized digital currency

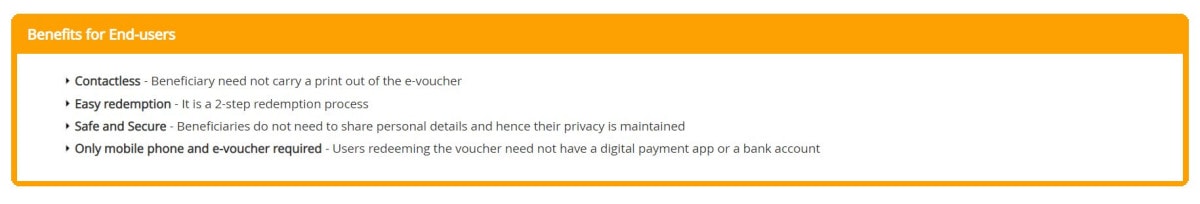

When explaining its purpose, the RBI stated that the majority of the rural population in the country does not have a debit card against their bank accounts. Without a physical or digital debit card, cashless retail transactions become impossible. The e-Rupi will address this challenge. The central bank digital currency (CDBC) will be distributed only by regulated entities. Users will need to go through a simplified KYC process to open their e-Rupi wallet.

How will people use the Reserve Bank of India’s e-Rupi?

During the official release, the Indian government will launch an e-Rupi app which can be used by the wider public. For the ongoing pilot program, the associated banks will create their own digital wallets to test the currency. Users can access the wallet through the respective bank apps. From Thursday, December 1st, the customers of these associated banks can avail e-Rupi through their apps.

The biggest difference between UPI and e-Rupi wallet is that the digital wallet does not need to be linked to any bank account. It will be its own separate entity, similar to crypto. Furthermore, the e-Rupi can be used through old analogue feature phones, so that its accessible to everyone. The new digital currency will also allow offline transactions, thus being more accessible for rural and remote areas.