Data shows the Bitcoin mining hashrate has continued its sharp plunge in the past week, as miners give up due to low revenues.

Bitcoin 7-Day Average Mining Hashrate Has Rapidly Gone Down Recently

According to the latest weekly report from Arcane Research, a miner capitulation might not have much impact on the price this time.

The “mining hashrate” is an indicator that measures the total amount of computing power connected to the Bitcoin network.

When the value of this metric goes up, it means miners are bringing more machines online right now. Such a trend shows miners are bullish on the crypto in the long term.

On the other hand, a decrease in the indicator’s value suggests miners are disconnecting some of their rigs currently. This kind of trend implies miners aren’t finding the blockchain attractive to mine on at the moment.

Now, here is a chart that shows the trend in the Bitcoin mining hashrate over the last six months:

The value of the metric seems to have been rapidly trending down in recent days | Source: Arcane Research’s Ahead of the Curve – November 29

As you can see in the above graph, the Bitcoin mining hashrate hit a new all-time high not too long ago. But since then, the metric has been going down.

The reason behind the downtrend is that the ATH levels of the metric lead to the network difficulty reaching a new high, which meant that revenues shrunk down for the individual miners.

As the block rewards are fixed and shared among the miners, more miners mean a smaller piece of the pie for everyone involved.

The decrease in the hashrate has been especially rapid during the last week, as the indicator has shed around 10% of its value in the period.

When miners come under heavy stress like they are right now, they have no choice but to sell off their Bitcoin reserves.

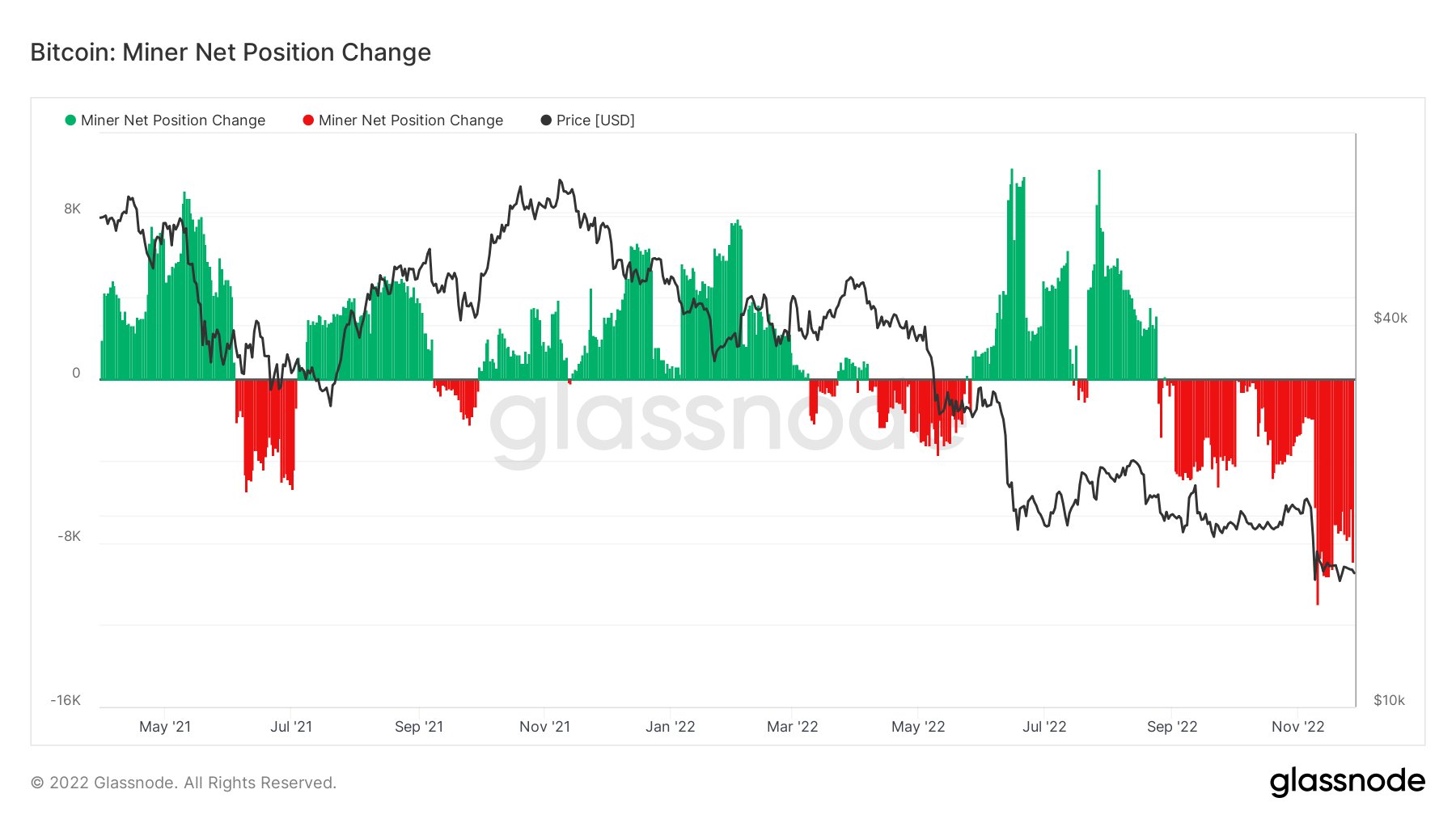

As the below chart shows, miners have indeed been doing some heavy selling recently as they have been transferring a large number of coins out of their wallets.

Looks like miners have been selling aggressively in the last couple of weeks | Source: Will Clemente on Twitter

Such miner capitulations have historically resulted in big crashes in the price of Bitcoin. One previous instance of such an event was during the plummet of November 2018.

However, the report believes that the market environment is different today, and thus it’s unlikely that the miners giving up would have any significant impacts on the price this time.

BTC Price

At the time of writing, Bitcoin’s price floats around $16.8k, up 2% in the last week.

BTC has surged up | Source: BTCUSD on TradingView

Featured image from Dmitry Demidko on Unsplash.com, charts from TradingView.com, Arcane Research

Source: https://bitcoinist.com/bitcoin-hashrate-sharp-plunge-miners-give-up/