Binance Coin price analysis shows a strong bull run in place at the current trend, as price moved above the $312 demand zone over the past 24 hours to record a high of $318.5. BNB has put together a solid upward ascent this week, as bulls carried price from a monthly low of $252 to record a 26 percent increment over the past few days. After moving above the crucial 200-DMA, bulls will look to target the $320 resistance before price correction could be expected.

The larger cryptocurrency market showed consolidations across the board, as Bitcoin rose up to $16,500 with a minor increment. Ethereum also moved up to $1,200, while Ripple lost 2 percent to move down to $0.399 as the only anomaly among major cryptocurrencies. Among other Altcoins, Cardano gained 1 percent to sit at $0.31, while Dogecoin recorded a similar increment at $0.09. Meanwhile, Solana rose up to $14 and Polkadot at $5.32, respectively.

Binance Coin price analysis: BNB powers ahead of moving averages on daily chart

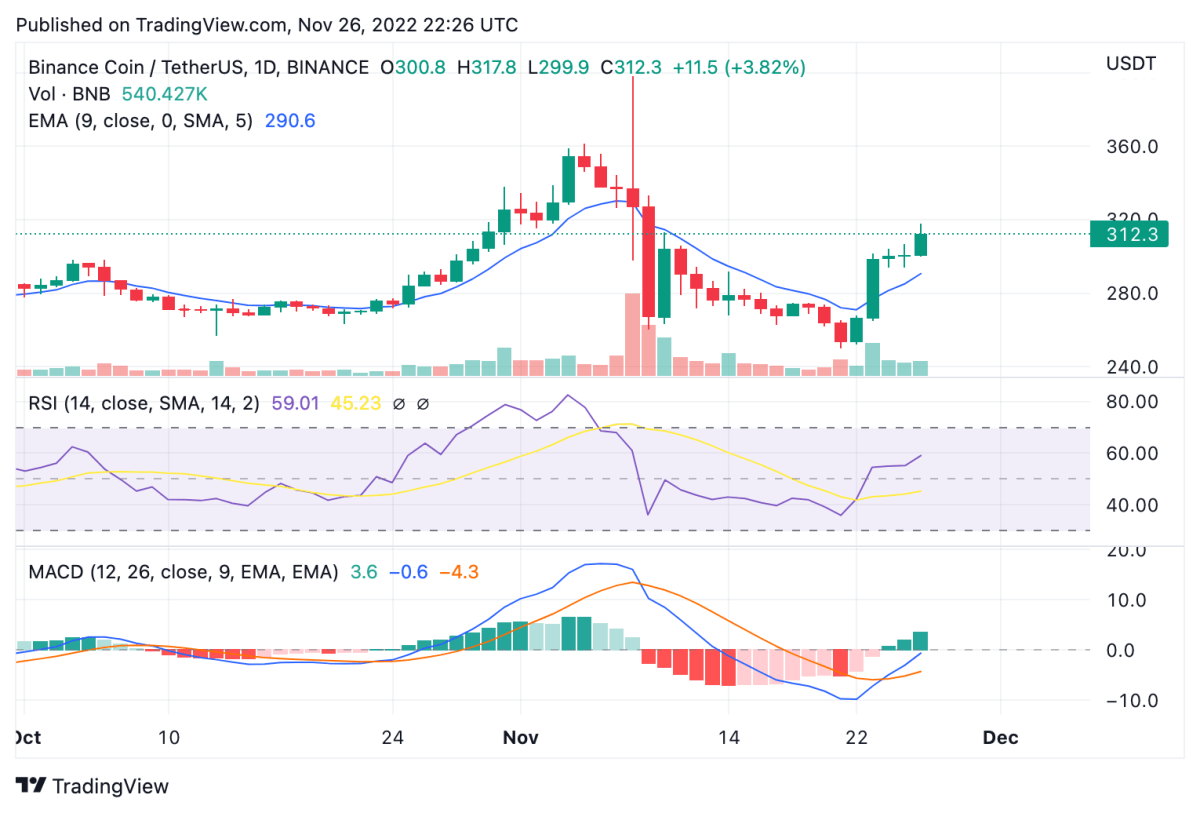

On the 24-hour candlestick chart for Binance Coin price analysis, an ascending triangle formation can be observed over the past week’s price action. Significantly over the past 24 hours, BNB market capitalisation grew up to $49.9 billion with an increase of 5.5 percent. Meanwhile, the upward price movement was accompanied by a 19 percent rise in trading volume, indicating a rise in market interest for BNB. Over the current run, BNB price has moved above the 9 and 21-day moving average on the daily chart, as well as the 50-day exponential moving average (EMA) at $291.8.

The 24-hour chart also shows a significant pickup in the relative strength index (RSI) which has moved up to 59.01 and could move into the overbought zone as price targets the $320 resistance point. Moreover, the moving average convergence divergence (MACD) curve can be seen attempting a bullish divergence over the past 24 hours to move above the neutral zone. Over the next 24-48 hours, BNB price will need to keep above the $300 mark to avoid correcting action, as market capitalisation is expected to hit the crucial $50 billion mark.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.