Bitcoin price analysis shows price decline deepened a further 3 percent over today’s trade, as price went down to $16,200. BTC has been in consistent decline since November 6, and a further 4 percent decline could push price to test the $16,000 support mark. The intraday Bitcoin volume went down to $24.9 billion, recording a 32 percent decline. Altogether over the current decline, Bitcoin’s market value has dropped around 76 percent from a high of $68,789. At current discounted price on offer, buyers could flock into the market and provide a relief rally up to the $18,000 mark at the start of next week.

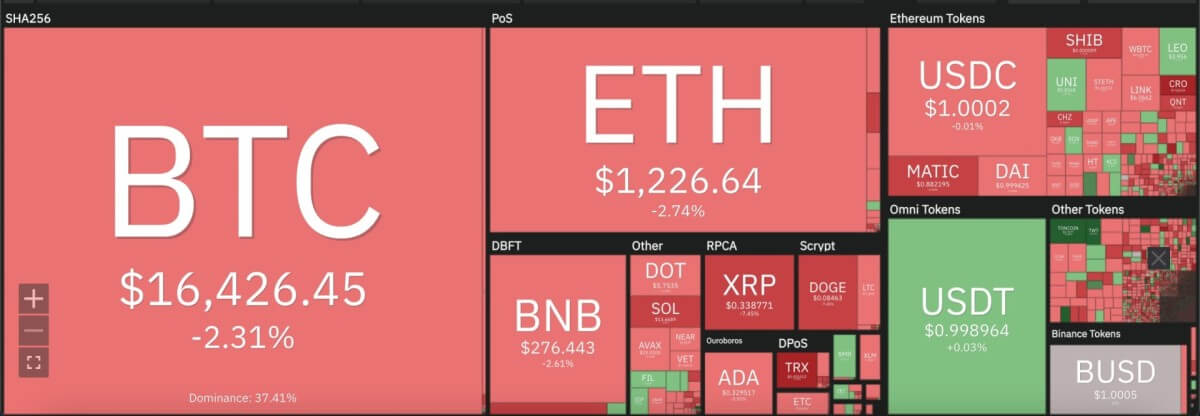

The larger cryptocurrency market largely stayed in decline, as Ethereum shipped another 3 percent to move down to $1,200. Ripple dropped 8 percent to move down to $0.33, while Cardano dropped down to $0.33 with a 4 percent decrement. Meanwhile, Dogecoin declined 7 percent to $0.06, with Solana shed 8 percent to move as low as $13.67 and Polkadot recorded a minor decrement to move down to $5.75.

Bitcoin price analysis: 24-hour RSI moves into severe under valued zone

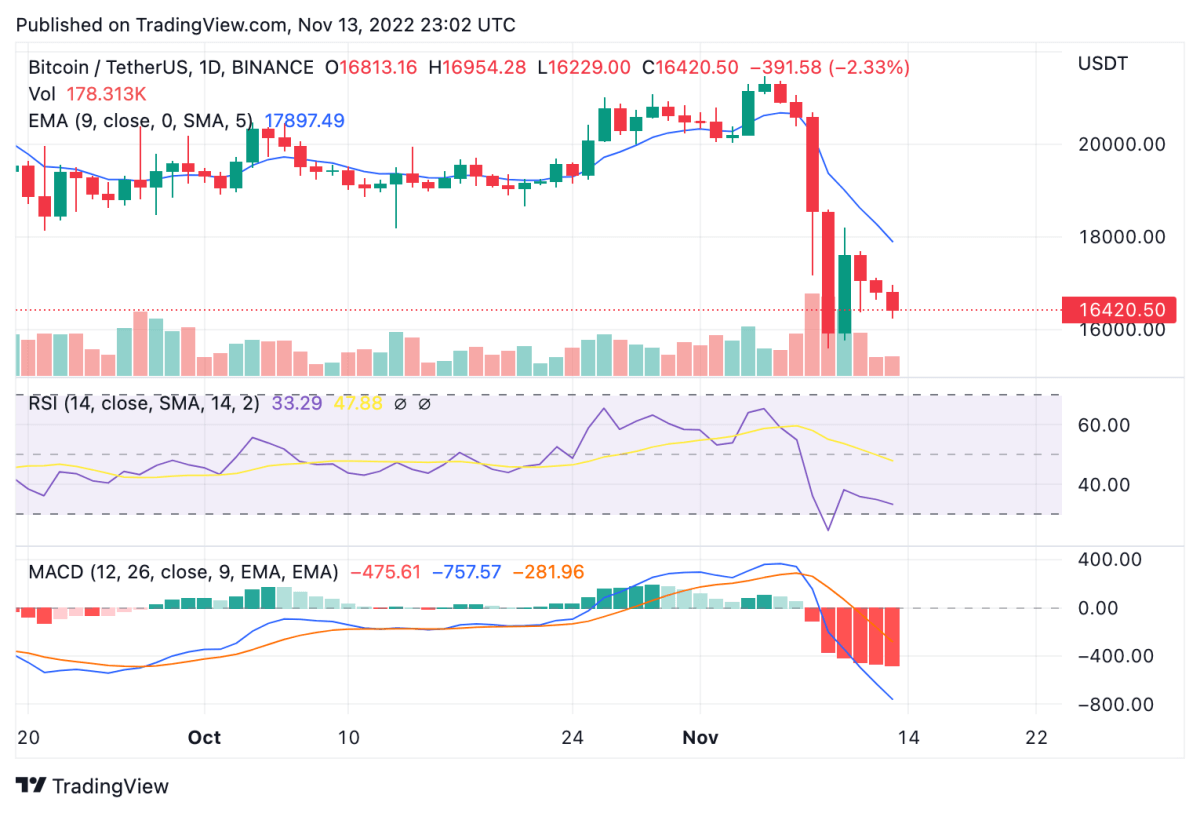

On the 24-hour candlestick chart for BItcoin price analysis, price can be seen recording consecutive days of decline since November 6, forming a downtrending pattern over the past 3 days. With this downtrend in place, the market for BTC provides an opportunity for buyers to formulate upward momentum towards the $18,000 mark. In this respect, the 24-hour relative strength index (RSI) shows a severely undervalued market status for BTC at 33.24. A bullish divergence in the RSI curve could indicate buying activity around the $16,000 mark.

Price has dipped severely below the 9 and 21-day moving averages over the past 3 days, including a move below the crucial 50-day exponential moving average at $17,894. Meanwhile, the moving average convergence divergence (MACD) curve can be seen forming a deep bearish divergence over the current price action. Volatility in the market currently is medium, while resistance levels sit at $18,200 and $20,000 whereas support can be found at $16,000.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.