Solana price analysis shows rising signs as the market shows massive upside potential. The bulls have regained their control of the Solana market, which will change the course of the market for the better, and SOL now expects the bullish period to take over in the next few days. However, the bears will do everything they can to regain control. As a result, the SOL price has experienced extremely increasing dynamics in the last few hours.

The market shows the price of Solana crashed yesterday to the $30 mark but spiked soon after to $33. Solana continues a positive movement. However, the next day, Solana prices spiked and reached $33. SOL currently trades at $33; SOL has been up 6.60% in the last 24 hours with a trading volume of $954,747,321and a live market cap of $11,957,932,430. SOL currently ranks at #10 in the cryptocurrency rankings.

SOL/USD 4-hour price analysis: Latest developments

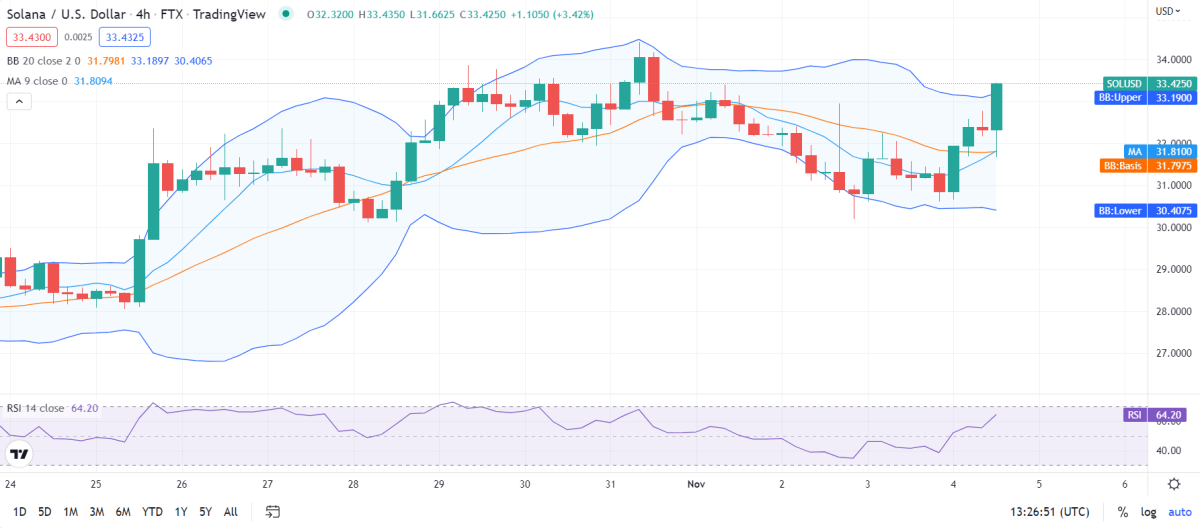

Solana price analysis illustrates that the present condition of the market demonstrates bullish potential as the price moves upwards. Moreover, the market’s volatility follows an increasing movement, making the cryptocurrency more susceptible to volatile change on either extreme. As a result, the upper limit of Bollinger’s band rests at $33.1, serving as another support point for SOL. Conversely, the lower limit of Bollinger’s band is present at $30.4, serving as a support point for SOL.

The SOL/USD price travels over the Moving Average curve, indicating the market is following a bullish movement. However, as the market experiences increasing volatility today, the Solana price has more room to preserve the positive trend. In addition, the SOL/USD price seems to move above the retraced resistance, signifying an increasing market with consistent dynamics.

Solana price analysis reveals that the Relative Strength Index (RSI) score is 64 making the cryptocurrency enter the inflation region. Furthermore, the RSI score moves further upwards, indicating that the buying activity dominates the selling activity while moving towards further inflation.

Solana price analysis for 24-hours

Solana price analysis has experienced an upward movement in the last few days. However, with the volatility increasing. Moreover, as the volatility increases, it makes the value of the cryptocurrency more vulnerable to change. As a result, the upper limit of Bollinger’s band rests at $34, serving as the most substantial resistance for SOL. Contrariwise, the lower limit of Bollinger’s band rests at $27, serving as the strongest support for SOL.

The SOL/USD price appears to be crossing over the Moving Average curve, displaying bullish momentum. However, the support and resistance are opening up, indicating increasing volatility with massive chances of maintaining a positive trend. Hence, the price moves upwards towards increasing characteristics.

The Relative Strength Index (RSI) score appears to be 58, showing the cryptocurrency’s stability. It falls above the upper neutral region. However, the RSI score follows an upward movement signifying a constant market and gestures toward increasing dynamics. The increasing RSI score indicates buying activity greater than selling activity.

Solana Price Analysis Conclusion

Solana price analysis shows bullish momentum and further bullish opportunities. Moreover, the bulls have shown their deterrence and might take control of the market soon for the long term as the market shows massive signs of any change. Therefore, according to this analysis, Solana is expected to have a promising future, with the bulls taking the bears completely out of the picture.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.