Cardano price analysis has become bearish once again, as sellers took over the market to lower price down to $0.4021 once again. ADA bulls had been making significant progress over the past 48 hours, as price moved up from a lowly $0.37 to $0.44. Over the past 24 hours, however, ADA faced a 5 percent decline to cause a test of the support zone at $0.35 once again. Price had moved into a saturation zone on the daily chart where the 24-hour RSI began to show an overbought state. Bulls will still look to target the $0.5 mark for November and could still find an uptrend before price touches the upper support floor at $0.38.

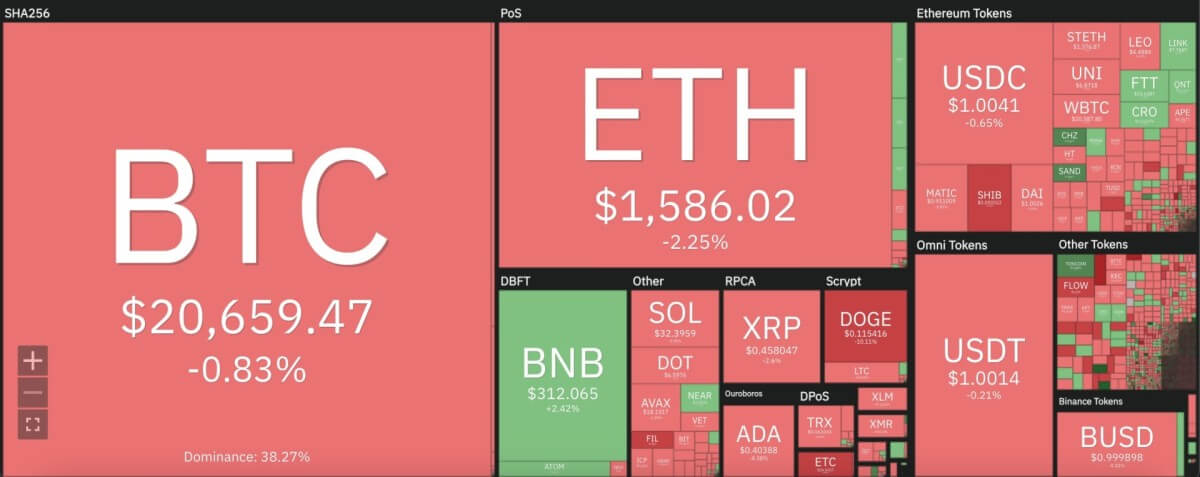

The larger cryptocurrency market showed similar signs of downtrends across the board, as major cryptocurrencies fell into the red state. Bitcoin dropped to $20,600, whereas Ethereum moved further away from the $2,000 mark with a 2 percent decline. Ripple also receded 2 percent to move down to $0.45, whereas Dogecoin dropped 10 percent after an impressive past 48 hours that saw price touch the $0.14 mark. Meanwhile, Solana and Polkadot dropped 2 percent each, to move down to $32.45 and $6.59, respectively.

Cardano price analysis: 24-hour RSI justifies price dip on daily chart

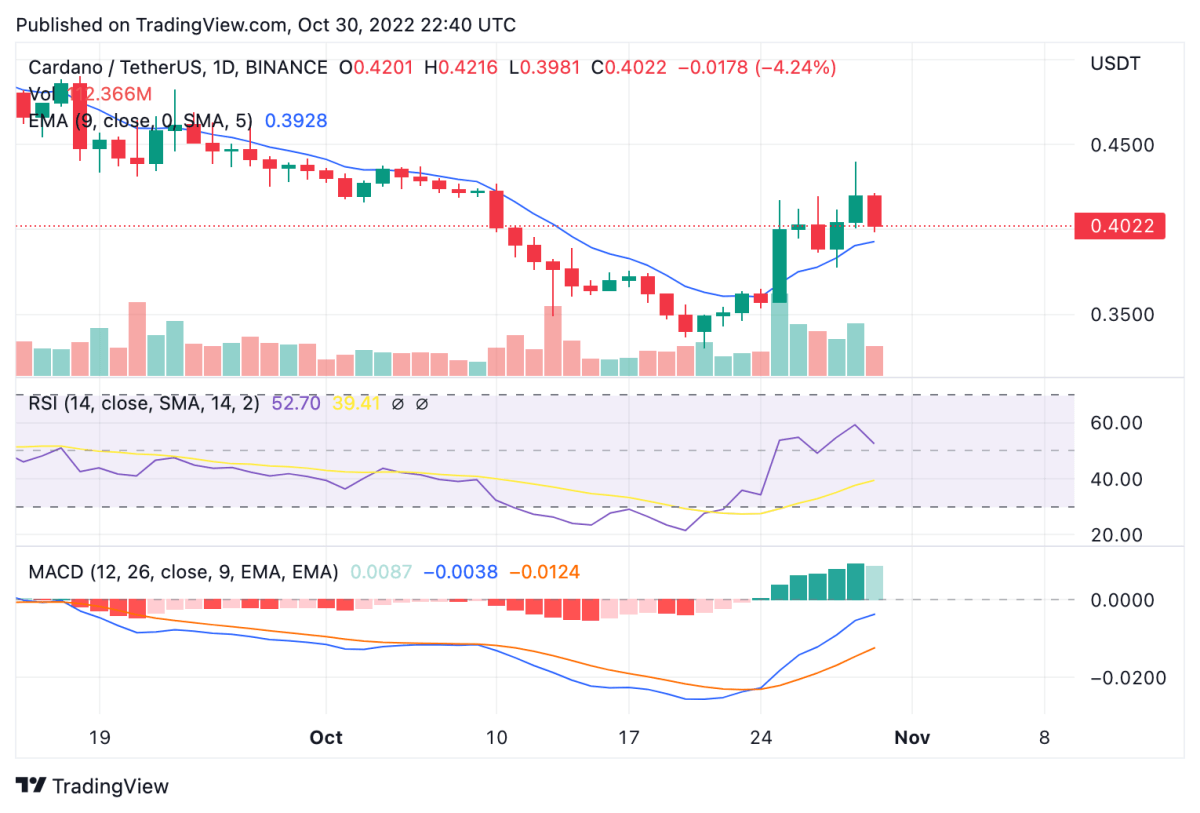

On the 24-hour candlestick chart for Cardano price analysis, price can be seen changing trends to decline more than 5 percent over the day’s trade. In what can be seen as an Evening Star pattern to shift price trend, ADA failed to complete a test of the $0.48 resistance point over yesterday’s price action and saturated at around $0.44. The 24-hour relative strength index (RSI) peaked yesterday to move into the overbought zone at 60, and can now be seen downtrending at 52.67. Meanwhile, trading volume also fell 30 percent over the past 24 hours to dictate downward price action.

Price still sits comfortably above the 9 and 21-day moving averages, along with the 50-day exponential moving average (EMA) at $0.39. The support floor is set at $0.35 for now, and bulls could come into the market again at a discounted price of around $0.38 as support is tested. The moving average convergence divergence (MACD) curve continues to show a bullish divergence to justify bullish potential in ADA over the current trend, as bulls continue to target the $0.5 price mark for November.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.