If you’re a crypto investor, staking is a concept you must have heard. Staking is a way many platforms allow participants to earn rewards for their holdings. But what is crypto staking? Cryptocurrency staking is a process that involves investing your crypto assets to support a blockchain network and confirm transactions. In return, you are incentivized.

If you’ve heard about how APE is currently trending, you might of course be interested in how to stake Apecoin; but wait a moment. If you’re unsure of the viability of the network, stay clear from tying down your financial assets and eventually losing better opportunities due to the locked-in period.

Crypto staking is available on blockchain platforms that use the Proof-of-Stake method to process transactions. Again, the process is a more efficient alternative to the original Proof-of-Work model. The proof of work method requires mining devices that use computing power to solve a mathematical problem. Staking can be a great way to use your crypto assets to earn passive income — especially those cryptocurrencies that offer high-interest rates for staking.

Remember that you will lose your crypto earnings if the coin’s value drops dramatically.

Today’s ApeCoin price is $6.73 with a 24-hour trading volume of $308,327,473. ApeCoin is down 8.72% in the last 24 hours. The current CoinMarketCap ranking is #33, with a live market cap of $2,066,705,863. It has a circulating supply of 306,875,000 APE coins and a max. supply of 1,000,000,000 APE coins.

Also Read:

- Bitcoin, Binance Coin, ApeCoin, and Decentraland Daily Price Analyses – 8 August Morning Price Prediction

- ApeCoin Price Prediction 2022-2031: A strong buy sentiment for APE?

- ApeCoin price analysis: APE rallies high to $7.27 as bulls mark 15 percent gains

What is ApeCoin?

APE was officially released in March 2022 as a token for gaming, culture, and commerce. Again, it’s the primary cryptocurrency of the Bored Ape Yacht Club ecosystem. This ERC-20 token has a market capitalization of US$4.02 billion, Based on the data by CoinMarketCap. However, about 28% of Apecoin’s fixed supply of 1 billion tokens is in circulation.

Apecoin {APE] is a governance utility token of the Apecoin ecosystem. Also, the platform is a decentralized protocol layer that supports the Apecoin community.

However, ApeCoin is an ERC-20 token that has a supply of 1 billion tokens. Controlled and built on by the community. The Apecoin DAO is a decentralized organization that allows all Apecoin owners to vote on governance decisions related to the token.

ApeCoin holders govern themselves via the decentralized governance framework controlling the ApeCoin DAO, and vote on how the ApeCoin DAO Ecosystem Fund should be used. In addition to this, Apecoin is adopted by Yuga Labs as the primary token for new products and services. However, Yuga Labs is the creator of Bored Ape Yacht Club {BAYC} NFT collections and owns popular NFT projects such as Cryptopunks and Meebits IP.

What is Ape Token?

APE’s official token acts as the utility token for the APE ecosystem, which focuses on improving the BAYC community. A utility token can be referred to as a token that enables users to carry out actions or initiatives on a specific network.

As an ERC-20 token, Apecoin can be used in four different ways

• Governance – APE is the governance token of the APE DAO that helps holders of the token to vote for governance decisions within the DAO.

• Access – Apecoin token provides limited access to certain parts of the ecosystem, such as merchandise, games, and exclusive events.

• Incentivization – APE is an avenue for third-party developers to participate in the ecosystem by integrating APE into projects, playing games, and other services.

• Unifying spending – APE can be used to purchase products and services such as playing to earn games that BAYC developed.

What is ApeCoin Staking?

ApeCoin Yuga Labs hasn’t allowed Apecoin staking for now, but it could change quickly, depending on its community proposals. The Apecoin forum has lots of AIPs that propose ApeCoin staking ideas.

The AIPs (proposals) are live, and holders vote on them. If they pass, they will pave the way for Apecoin staking.

However, if you can’t wait until these AIPs pass, there are other options to staking ApeCoin. Like most PoS tokens, you can stake APE on any cryptocurrency exchange that provides staking services. Binance offers staking periods of 30, 60, and 90 days, with different APYs just by staking APE. All you need to do is to choose your staking package, make a deposit, and earn token rewards.

How to Stake Apecoin on Binance

You can stake your Apecoin on Binance through “Binance Earn.” However, Binance Earn staking mechanism is simple; you can select dozens of crypto financial products with the platform, transfer your crypto to the chosen solution, and watch your funds grow.

Step 1: Register an account on Binance and verify your identity

Open an account on Binance and verify your account. Note that Binance will ask for means of identity. So make sure you have them handy.

Step 2: On the Binance dashboard, click on Earn and select Staking

On your dashboard, select Earn and click on staking. Under your Lock Staking, search for APE. Then pick your preferred staking duration (Flexible) and click Subscribe.

How to Stake Apecoin on Gemini

Gemini also allows you to earn ApeCoin. On the platform, up to 5.58% can be earned on Apecoin. It is simple to stake coins on Gemini. Here are easy steps to do so:

Step 1: Open a Gemini account

Open a Gemini account by clicking on Get Started on the home page. Ensure you verify your identity. Purchase your preferred amount of Apecoin immediately.

Step 2: Transfer your purchased Apecoin to Gemini Earn

Go to Gemini Earn, then click on Get Started to start earning interest on your holdings

How much do you earn while Staking ApeCoin?

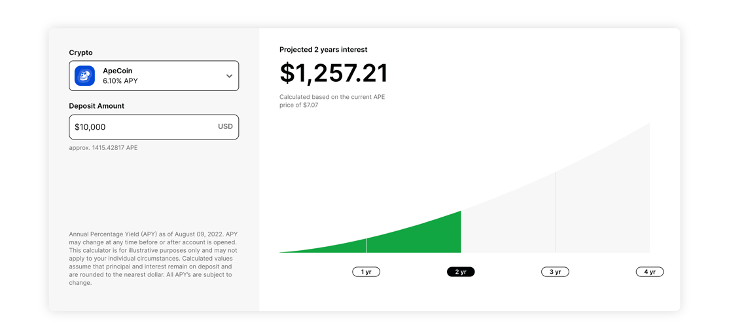

Using Binance, you will earn a 3.00% APY. This means that on your first deposit of ApeCoin tokens, you will get 3% on a 30-day staking period. On Gemini, you will earn a 6.10% APY on the 60-day staking period.

Whichever APR you have: nominal or actual, multiply (1-validator’s commission) for the final actual staking APR. Validators offer a variety of commission rates, so users are able to select their preferred validators for an optimized portfolio. To sum up, the APR briefly shows how much the interest will be in staking.

When staking cryptocurrency assets, APR(Annual Percentage Rate)/ APY (Annual Percentage Yield) is one of the most crucial factors to consider for optimal efficiency. Staking reward comprehensively includes income from inflation and transaction fee distribution.

Simply put, your staking APR is calculated as below:

[Inflation * (1-Community Tax)] / Bonded Tokens Ratio

- Annual provision is the number of blocks increased on a blockchain in one year.

Annual Provision = (Current Total Supply) * (Inflation Rate)

According to the inflation rate, the number of blocks to be provided in one year is decided: annual provision. Let’s say the current supply of a token is 1000 and the inflation rate is 10%, then the annual provision would be 100 tokens. These 100 tokens are distributed to the staking users as a reward, accordingly to the bonded tokens ratio of the network. Basically, in staking APR, the inflation-driven interest is distributed from the annual block provision to staking users.

- Community tax, in most cases, is relatively small, for example 2% (it’s not much, but it’s an honest contribution to the community).

What we’ve discussed above is how the “nominal” APR is calculated, theoretically. On the other hand, there are a couple more things behind the scene that we have to take into consideration for the calculation of actual APR.

Actual Staking APR = (Nominal APR) * [(Actual Annual Provision) / (Annual Provision)]

Final Staking APR = (Actual Staking APR) * (1-Validator’s commission)

As we can see, the actual APR is slightly lower than the nominal APR shown due to the community tax, bonded tokens ratio and validator’s commission fee.

Benefits of Staking ApeCoin

• APE as a governance token – Apecoin DAO is part of the governance structure of the {BAYC} line of NFTs. However, this means that anyone owning Apecoin will have a say in the decision that the Apecoin ecosystem takes.

• Events Payment – APE has a strong use case as a payment method for related crypto events.

• Staking can be done quickly – You can easily stake Apecoin at the different crypto-exchange platforms without difficulty or requiring complex equipment.

• A long-term investment technique – Apecoin staking is a long-term investment option that allows users to earn profits if APE experiences any gain in value.

Risk in Staking ApeCoin

• Liquidity Risk – A crypto platform’s liquidity depends on the assets liability converted to digital coins or cash. Hence, Apecoin is susceptible to liquidity risks.

• Loss of Funds – With the invention of blockchain technology, crypto theft has become a threat threatening crypto owners and services used daily.

• Impermanent loss – This is a common downside of crypto staking and a risk to the crypto industry. Knowing that crypto markets are volatile makes the value of a token rise and fall constantly.

Should you stake ApeCoin?

So, is APE worth staking? Right now, it is fair enough on different crypto exchange platforms – maybe it would be better once Apecoin Yuga Labs allows staking on their platform. While no investment is without risk, investing in Apecoin has generated a bigger return over the last few months.

As stated in this guide, you can earn interest on your APE coin when you stake on the platforms listed above. If you are a newbie and want to start earning passive income on APE, you must know what is at stake before investing in digital assets.

Nonetheless, the final decision comes down to you. If you have the same perception as most people, then stake enough APE that you can afford to lose through Binance or Gemini.