Fidelity’s director of global macro is evaluating where Bitcoin (BTC) and Ethereum (ETH) stand after months of price capitulation.

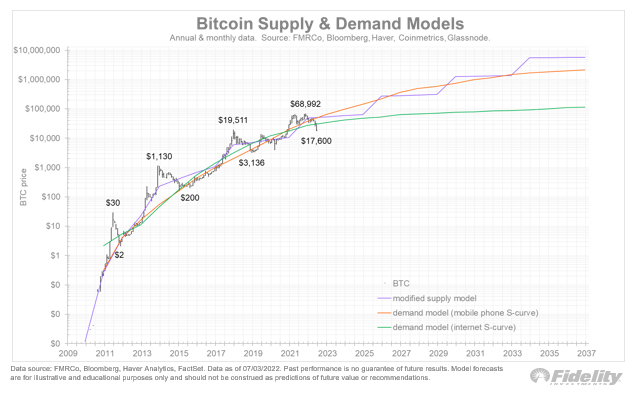

Jurrien Timmer tells his 131,200 Twitter followers that Bitcoin is likely undervalued at current prices based on his S-curve model.

The model attempts to gauge the value of BTC by predicting the future growth of its network based on the rate at which users adopted the internet.

“Bitcoin and crypto in general have not been spared from the widespread drawdowns this year, and that’s an understatement.

At its recent low of $17,600, Bitcoin is now below even my more conservative S-curve model, which is based on the internet adoption curve.”

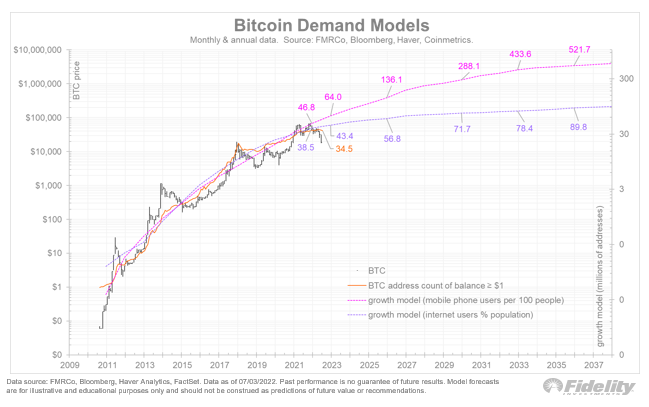

Timmer next shares his belief that the pace of Bitcoin adoption more closely resembles that of the early internet than mobile phones, referencing Metcalfe’s Law, which states that a network grows in value as the number of users on the network gets bigger.

“Looking at Bitcoin’s network growth, it’s clear that the adoption curve is tracking the more asymptotic internet adoption curve, rather than the more exponential mobile phone curve.

Per Metcalfe’s law, slower network growth suggests a more modest price appreciation.”

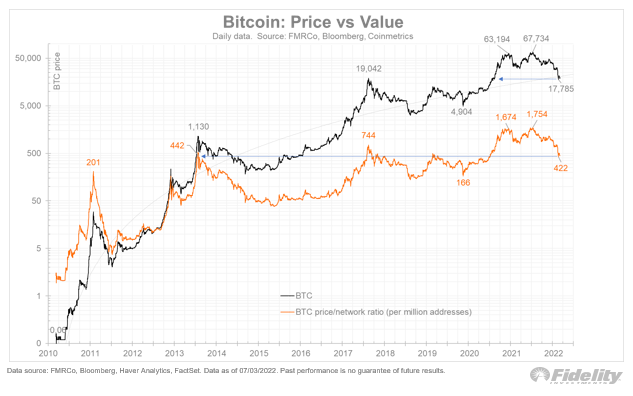

Timmer adds that he’s also looking at the number of non-zero Bitcoin addresses as a method of calculating BTC’s true worth, saying that it’s still deeply undervalued despite being in a bear market.

“I use the price per millions of non-zero addresses as an estimate for Bitcoin’s valuation, and the chart below shows that valuation is all the way back to 2013 levels, even though price is only back to 2020 levels.

In other words, Bitcoin is cheap.”

At time of writing, Bitcoin is up 1.28% over the last 24 hours, trading for $21,806.

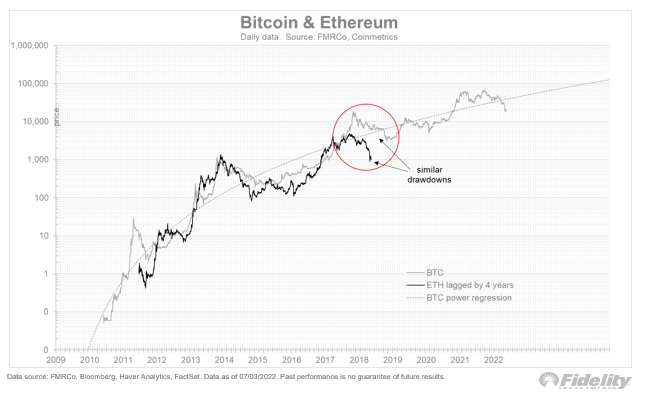

The analyst wraps up his thread by asking whether Ethereum could be considered relatively cheaper than Bitcoin. Timmer compares ETH’s current price drawdown with Bitcoin’s 2018 bear market, assuming that Ethereum’s price action is just behind Bitcoin’s market cycle by four years.

“If Bitcoin is cheap, then perhaps Ethereum is cheaper.

If ETH is where BTC was four years ago, then the analog below suggests that Ethereum could be close to a bottom.”

Ethereum is trading sideways on the day with an asking price of $1,231.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/EvojaPics/VECTORY_NT

The post Ethereum (ETH) Bottom Finally In? Fidelity’s Macro Analyst Says Price of Bitcoin (BTC) Offers a Clue appeared first on The Daily Hodl.