Ethereum is back in red after a consistent rise toward $3,000. The breakout from last week’s key support at $1,750 failed to overcome seller congestion at $2,900. Note that the ongoing retreat is not unique to Ether but appears to be pulling the whole market down.

Bitcoin has been rejected at $40,000 and currently seeks support toward $36,000. The cross-border money transfer token has also lost the battle above $1 and moves toward $0.9.

Ethereum technicals could flip massively bearish

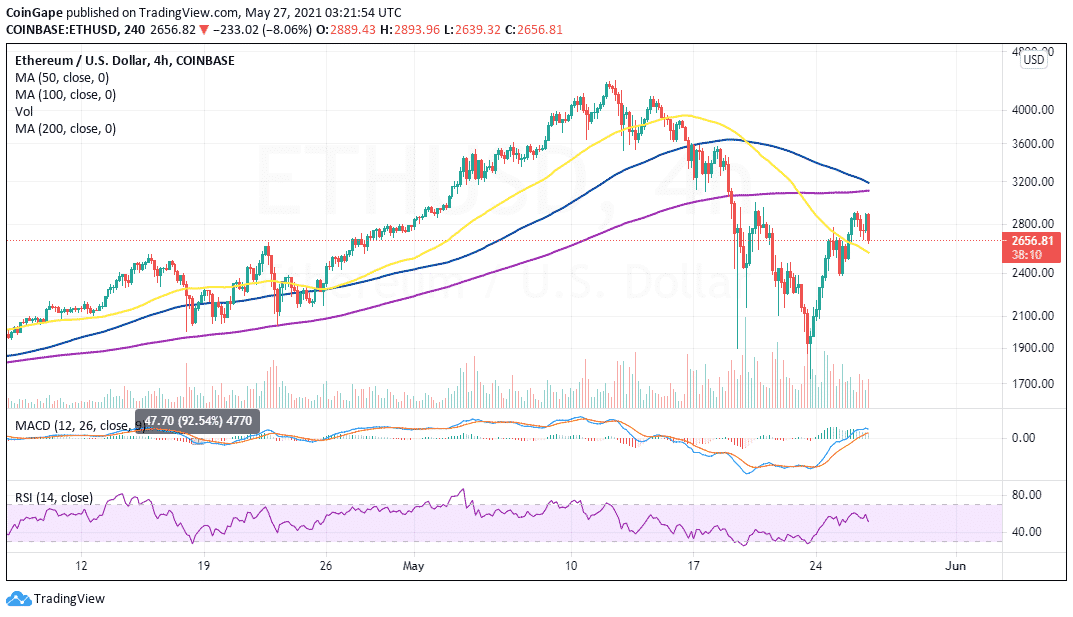

The gigantic altcoin trades at $2,660 at the time of writing. The correction from the failed attempt to clock $3,000 looks unstoppable at $2,600. However, the 50 Simple Moving Average (SMA) is in line to halt the potential losses eying $2,400 and $2,000, respectively.

It is worth keeping in mind the short-term technical outlook, which continues to weaken. For example, the Moving Average Convergence Divergence (MACD) has stalled at 90 and could soon assume a downward trajectory. Losses are likely to intensify if the MACD line (blue) flips below the signal line. The trend momentum indicator diving will accentuate the bearish outlook toward the mean line (0.00).

ETH/USD four-hour chart

The Relative Strength Index (RSI) on the four-hour chart has a vivid bearish impulse coming after an abandoned movement to the overbought region. As the RSI retraces to the midline, the bears’ grip tightens, making it difficult for bulls to fight for recovery. Hence, the least resistance path remains downward.

Looking at the other side of the fence

Support at $2,600 and the 50 SMA has the potential to hold Ether from stretching to lower levels. In other words, buyers can start focusing on recovery if these levels hold as strong anchors. On the upside, trading above $2,900 and $3,000 could be instrumental in pulling Ethereum toward $4,000.

Ethereum intraday levels

Spot rate: $2,660

Trend: Bearish

Volatility: High

Support: The 50 SMA and $2,400

Resistance: $2,900and $3,000

The post Ethereum Price Forecast: ETH breakdown to $2,000 looms in the wake of rejection at $2,900 appeared first on Coingape.