An original artwork by iconic British street artist Banksy, named “Morons,” has been physically burned and transformed into a digital representation—known as an NFT—by a group of collectors and investors. This digitized art-form, the group argues, is the future of the art industry.

Morons, which had an estimated value of $70,000 before it was burned, ridicules art collectors for purchasing expensive pieces of art. It was destroyed in Brooklyn, New York, this afternoon, and the event was live-streamed to a global audience. Prior to its destruction, the work was authenticated by Pest Control, a body Banksy set up to verify his art.

“The main intention here is to be the first ever event where a physical piece is turned into a digital piece,” a representative from the group responsible told Decrypt. The group includes Decentralized Finance (DeFi) projects Injective Protocol and SuperFarm.

Destructive forces at work in the art world

Non-fungible tokens have taken the world by storm in recent weeks, with one piece, by crypto artist Beeple, fetching over $6 million. The total value of crypto art sold in the form of NFTs is fast approaching $200 million, and celebrities such as Grimes are getting in on the action. The musician, who is also Elon Musk’s girlfriend, made over $6 million auctioning her collection of NFTs last weekend.

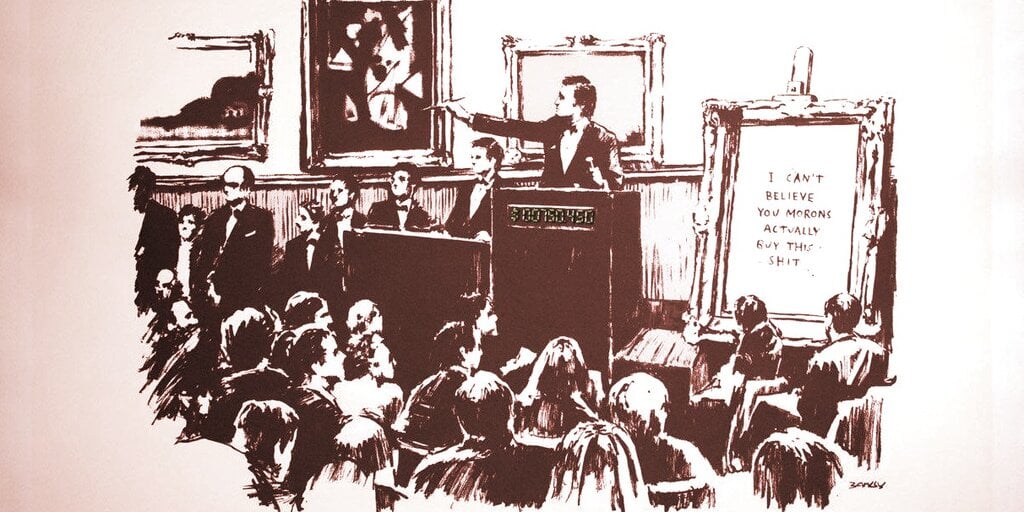

Banksy’s Morons depicts a historical moment in the art world, when Van Gogh’s Sunflowers achieved a record-breaking hammer price of £22.5 million in 1987, sparking the beginning of colossal changes in the art market, with the emergence of the first “mega lot” auctions.

In the image, a canvas being auctioned depicts the words, ‘I CAN’T BELIEVE YOU MORONS ACTUALLY BUY THIS SHIT.’

Banksy’s mockery of art collectors ready to bid huge sums of money in order to buy his work, or that of famous other famous artists, made him an obvious target for their project, said the spokesperson.

The destroyed artwork will now be turned into an NFT, on the SuperFarm marketplace, according to a press release, and will soon be up for auction itself. The winning bidder will receive the unique digital code that identifies the work, and the Pest Control certificate of authenticity. A portion of the proceeds from the sale will be given to charity, according to the press release.

Banksy artworks have already been appropriated and transformed into NFTs, making one artist nearly a million dollars—before the practise sparked controversy. But this is the first time that a Banksy, or any original artwork, has been destroyed and digitized in this way, the enthusiasts behind the project claim. And the group plans to continue such work, spurring “a new age in the world of art where artistic works can live on digitally forever, ” according to the release.

“We plan to burn a few pieces after this one as well,” said the spokesperson. “It will also likely become more mainstream to burn a piece [of art] in the real world in order to mint it into an NFT.” But they added that, since this is the first time it’s being done, the value will be higher, given the novelty of the event itself.

In the real art world, in 2018, a similar stunt was pulled by no other than Banksy himself. His iconic print “Girl with a Balloon” was shredded seconds after it went under the hammer for $1.4 million, in an event that took the art world by storm.

Far from devaluing the work, experts said the stunt may have actually doubled its value, because of the interest it generated. But, when a similar enterprise was later attempted by the owner of a Banksy work, art experts said the $55,000 print was rendered practically valueless, as only the original artist could pull off such an act.

Who is buying NFT art?

Some art experts question the very legitimacy of the NFT market itself.

“I am suspicious because we don’t know who is buying the NFT art,” said Ben Lewis, a film-maker, art historian and author of “The Last Leonardo,” the story of the world’s most expensive painting.

Lewis has made a number of investigative documentaries for the BBC on the art market, including “The Great Contemporary Art Bubble, and “A Banker’s Guide to Art.” His theory, and he stresses that it’s “only a hypothesis. I have no proof,” is that a few rich crypto-millionaires are trying to establish a new art market. “So they agree to bid stuff up at an auction, punting a bit of their new money on it, in the hope that other buyers get drawn into the market.”

It’s a practice that’s not unusual in the art world, and Lewis points to Grimes’ involvement, as “one tiny piece of evidence that supports the hypothesis.” And, until we know the names of the buyers—which of course we probably never will—he contends that it remains a plausible hypothesis.

But while some in the traditional art world are suspicious, a burgeoning movement of NFT artists and collectors is still riding the crest of an enormous wave.