Crypto derivatives are now among the most common financial products on any cryptocurrency exchange or trading platform, thanks to increased interest among the trading community. Trading crypto derivatives has its own advantages as it allows users to mitigate volatility-associated risks and hedge against potential losses.

There are various derivatives products that include Swaps, Futures, Forwards, Options and Perpetual Futures. With the right skills, on the right platform, traders can make the best out of these instruments and earn a small fortune in the process. However, finding the right platform is the key.

If one were to list five of the best crypto derivatives exchanges in the market, they would be:

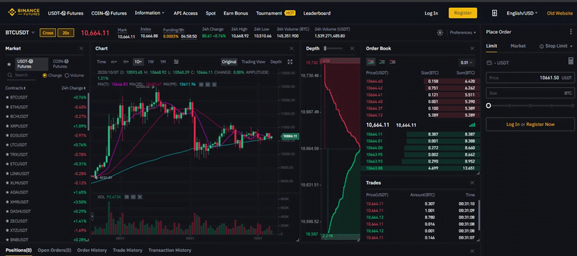

Binance

Taking the top spot on the list is Binance Futures, which leads the rest when it comes to 24-hour volumes. While it is popular for the spot trading feature, it also features margin and futures trading. Being one of the relatively older and a reputable crypto platform, trading on Binance is a straightforward process. It offers Perpetual Contracts with leverage of up to 125X and is found to be ideal for shorting Bitcoin and other cryptos without having to maintain a large BTC deposit in the user’s account.

Traders can also benefit from the margin trading feature for BTC and altcoins with up to 1:3 leverage. Binance Futures generally has a low fee structure, supports more than 200 altcoins, and also offers an option to trade limited volumes anonymously. However, the platform is not available in certain geographies, including the USA, and doesn’t support fiat payments.

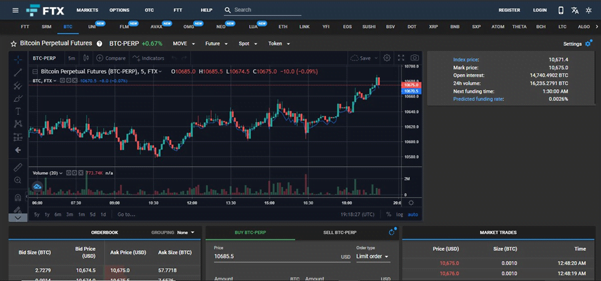

FTX

FTX is a crypto derivatives trading platform that is designed by a bunch of traders with Wall Street experience. A relatively new platform, it offers a range of innovative trading instruments like Perpetual Futures, crypto indices, volatility contracts and more. In addition, it also has special FTX leveraged tokens that are ERC-20 tokens for leveraged exposure to crypto markets without many specifics.

Available in 14 different languages, the platform supports over 30 cryptocurrencies and some of the leading fiat currencies without any deposit or withdrawal charges. On the platform, traders can obtain leverage of up to 101x while paying some of the industry’s lowest trading fees at 0.07%. FTX also implements some of the standard security features including the latest encryption, 2FA and more.

However, being a relatively new trading platform FTX is yet to gain a reputation in the market and expand to more geographies.

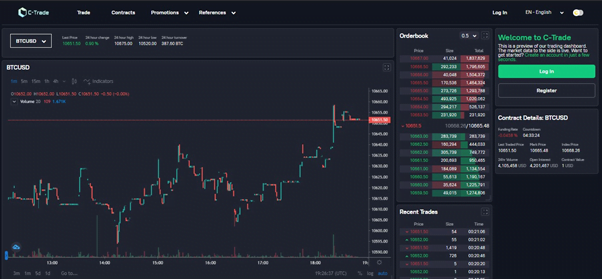

C-Trade

A relatively new, next-generation crypto derivatives trading platform, C-Trade has quickly risen in the market and aims to become a crypto derivatives marketplace. C-Trade has come to be known for its lightning-fast secure trading infrastructure offering cryptocurrency Perpetual and Futures contracts. The platform also has options, warrants and other structured products in the pipeline designed to suit the trading community’s varying needs.

C-Trade is created by a team of tech entrepreneurs with expertise in traditional equity derivatives trading and crypto asset management. The team has an in-depth understanding of the market as well as the needs and preferences of traders, which has enabled them to create a reliable, secure, and user-friendly crypto derivatives platform.

C-Trade employs a highly capable matching engine that can handle over 100,000 TPS, which along with updated Spot Price Index and Mark Price Index systems, ensures the reliability of trades. Along with a maximum leverage of 150x, C-Trade has a low fee structure and approves withdrawals in minutes. It is also known for exceptional customer service that can be reached through multiple channels including live chat, contact form, email, or social media. The support team at C-Trade is highly qualified and capable of answering the queries in no time.

Even though the trading volumes are lower than its counterparts, which is quite common among young platforms, C-trade finds a place for itself as one of the hottest emerging crypto derivatives trading platforms. Currently, C-Trade is running a BTCUSD Perpetuals trading competition and offers a rewards program where users can earn up to $200 as rewards.

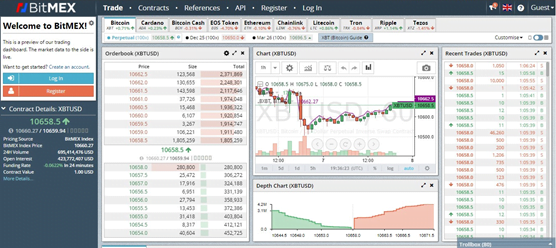

BitMEX

Short for Bitcoin Mercantile Exchange, BitMEX is one of the largest Bitcoin trading platforms that has been operational since 2014. It is a Bitcoin-only platform that accepts deposits and withdrawals in the flagship crypto alone.

BitMEX has a comprehensive, feature-rich trading dashboard with all the tools and charts necessary to make trading decisions. The platform implements adequate security and risk management measures including an insurance fund, auto deleveraging capabilities, and price manipulation protection.

Currently, users on BitMEX can avail up to 100X leverage and the trading fees are on par with those of its industry peers. While the platform is highly reliable and has gained the confidence of the crypto community, it is best suited for experienced traders which makes it an attractive platform for crypto whales and institutional investors.

However, the list of cryptocurrencies supported on BitMEX is limited compared to others. It is also known to experience occasional system overload problems causing inconvenience to the trading community. It is also a target of multiple lawsuits.

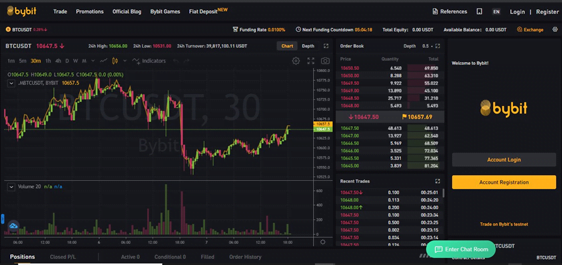

Bybit

The Singapore headquartered Bybit is yet another fast-growing crypto derivatives platform with daily trading volumes that puts it among the top 10 exchanges in the market. Started in March 2018, Bybit offers a user-friendly, intuitive, and smart platform for Perpetual Contracts trading with up to 100x leverage. The platform offers flexible deposit options which include BTC, ETH, EOS, XRP and even fiat currencies that can be used to make deposits as less as $5 to start trading.

Other notable features of Bybit include real-time market data, customizable trading dashboard, reliable customer support, insurance fund, and ADL for risk management. However, the number of contracts offered on the platform are limited to 4-5 compared to the likes of C-Trade.

Verdict

Each of these five platforms come with their own strengths and weaknesses. For example, Binance is one of the leading crypto platforms with the highest volumes and userbase. On the other hand, users on FTX can experience lots of new crypto trading products as it works on building its userbase. Competing closely with FTX is C-Trade, which is also a relatively new platform offering an attractive welcome bonus, quick withdrawal, and the best leverage. Apart from round-the-clock security and high-performance matching engine, the platform also scores high on the customer support department.

Meanwhile, BitMEX is the pioneer of crypto derivatives exchange and has been around for a long time. But the recent litigations and the system overload issues remain to be a concern. And finally, Bybit offers a user-friendly crypto derivatives platform with limited trading products, which it makes up for with its transaction processing capabilities.

These five crypto derivatives exchanges are just a tip of the iceberg, as there are many platforms out there offering a variety of trading products and features. Traders looking to pick the right platform to suit their needs can always try as many as they wish before making a selection. Some of these platforms also offer an attractive welcome bonus for new users, which can come in handy during the decision-making process.

Image by Gerd Altmann from Pixabay

Source: https://www.newsbtc.com/news/top-5-crypto-derivatives-exchange-in-2020/