Bitcoin underwent multiple rejections in the $11,000 region over recent weeks, suggesting the asset remains rangebound. Fortunately for bulls, there are on-chain trends suggesting that the cryptocurrency is in a bullish state. There are also underlying fundamentals like a commitment to inflation by the Federal Reserve that could spur further BTC purchasing.

Related Reading: MicroStrategy’s Stock Continues to Soar After Bitcoin Purchase

Bitcoin’s On-Chain Trends Suggest the Prevailing Trend Is Bullish

Bitcoin’s recent price action has been cautious at best but analysts seem convinced that the prevailing trend is bullish.

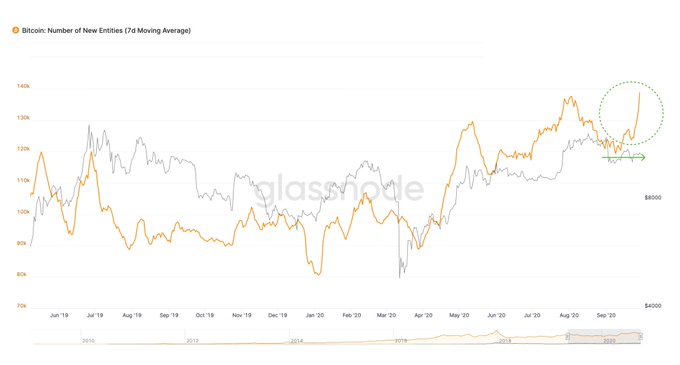

Willy Woo, an on-chain analyst, recently shared the chart below. It shows that the cryptocurrency is seeing a spike in new users (as measured by Glassnode) despite the price of BTC stalling. Woo thinks that this is an “obviously bullish” divergence that may resolve to the upside:

We’re seeing a spike in activity by new participants coming into BTC not yet reflected in price, it doesn’t happen often. This is what traders call a divergence, in this case it’s obviously bullish.

Adding to this, Woo explained that an influx of on-chain Bitcoin is currently changing hands. This should suggest that there will soon be a bullish reversal as spikes in BTC changing hands have marked trend reversals over the past few months:

“We’re seeing another impulse of coins changing hands completing. My interpretation is that the last pulse was take profit, halting the downward move; this impulse should be the one that drives us upwards.”

Related Reading: Critical On-Chain Signal Predicts That Bitcoin’s Next Move Will Be Upward

Fundamental Trends Also Bullish for BTC

Fundamental trends also seem poised to drive the cryptocurrency to the upside.

Dan Tapiero, co-founder of 10T Holdings, Gold Bullion International, among other firms, recently stated that Bitcoin will drive higher due to an influx of global liquidity.

“Massive global liquidity to hit mkts NEXT year. Chart suggests #equity mkt at risk of correction in Q4, then single greatest rally of our lifetime in 2021. Enormous speed and near vertical price increase possible. Might be led by #GOLD this time. #Bitcoin would benefit too.”

While he is bullish on the crypto-asset, Tapiero recently said that Bitcoin is currently irrelevant on a macro scale.

He went as far as to say that Bitcoin’s market capitalization may need to gain upwards of 2,000% before it is considered relevant by “macro authorities.” This may be a good thing as it may not be targeted by regulators until it grows to that point.

Related Reading: Ethereum Transaction Fees Surge to All-Time Highs After Uniswap Launch

Photo by Jonatan Pie on Unsplash Price tags: btcusd, btcusdt, xbtusd Charts from TradingView.com Bitcoin's On-Chain Trends Are "Obviously Bullish" Right Now