Ethereum is slipping lower despite a 5% rally in the price of Bitcoin, seemingly spurred by the inflows of MicroStrategy’s latest over $100 million BTC purchase. The leading cryptocurrency has slid from its local highs near $390, set last week, to $355 as of this article’s writing. The coin reached as high as $375 earlier Tuesday.

While Bitcoin is holding up well, trading for $10,750 as of this article’s writing, analysts are once again getting bearish on the crypto market’s prospects.

One trader thinks that Ethereum is primed to plunge under the critical $300 support level to lows not seen in over a month. This drop could mark the end of the ongoing “altcoin season” that has sent many cryptocurrencies skyrocketing higher over recent months.

Related Reading: This European Crypto Exchange Was Just Hacked for $5 Million

Here’s Why an Analyst Thinks Ethereum Could Soon Fall Under $300, Then Even Lower

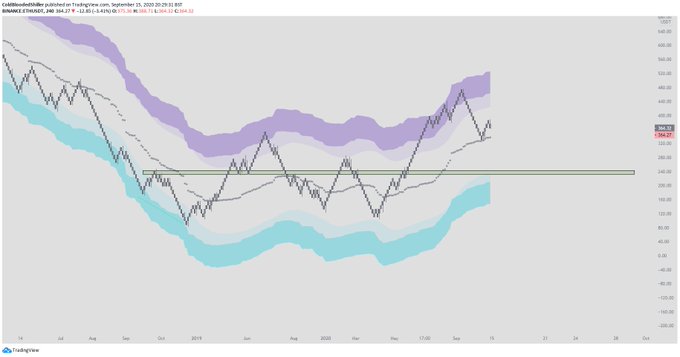

Ethereum could soon hit $240 as selling pressure mounts, one trader recently suggested:

“Actually just going to pitch straight for $240 as the target for $ETH. Rejection looking rough still on the Daily, nothing that’s changed the trade or the plan.”

Chart of ETH's price action over the past few years with analysis by crypto trader Cold Blooded Shiller (@ColdBloodShill on Twitter). Chart from TradingView.com

Despite the short-term weakness, analysts remain convinced that Ethereum’s long-term trend is still skewed positive. One trader shared the chart below, showing that ETH’s recent moving average action looks similar to Bitcoin did in 2016. This suggests that ETH will soon move higher than $1,000, which would mark an over 200% rally from current levels:

“ETH daily MA’s have now aligned in a perfect bullish configuration as for BTC in 2016. Extending the Daily MA200 (in red) as if it is a trend line we can have a projection of ETH by 2023.”

Related Reading: Here’s Why This Crypto CEO Thinks BTC Soon Hits $15,000

Eyes on the FOMC Announcement

What may save Ethereum in the short term is the upcoming FOMC announcement by Federal Reserve Chairman Jerome Powell.

The Federal Open Market Committee will announce tomorrow potential changes or shifts in monetary policy and the economy that could positively affect all asset prices, Ethereum included.

Related Reading: It’s “Logical” for Ethereum To Reject At Current Prices: Here’s Why

Featured Image from Shutterstock Price tags: ethusd, ethbtc Charts from TradingView.com Here's Why an Analyst Thinks Ethereum Will Soon Hit $240