Bitcoin has extremely strong price action over recent days. At the highs of the rally on Monday, the leading cryptocurrency traded as high as $11,500 on leading margin exchanges.

There remain signs that BTC could undergo a strong retracement after surging as high as $11,500. This comes in spite of the fact that BTC is already down by approximately $700 from the local highs as of this article’s writing.

The following are three signs that BTC could retrace as shared by analysts.

Related Reading: Crypto Tidbits: Ethereum Surges 20%, US Banks Can Hold Bitcoin, DeFi Still in Vogue

#1: A Potentially Overextended Bitcoin Futures Market

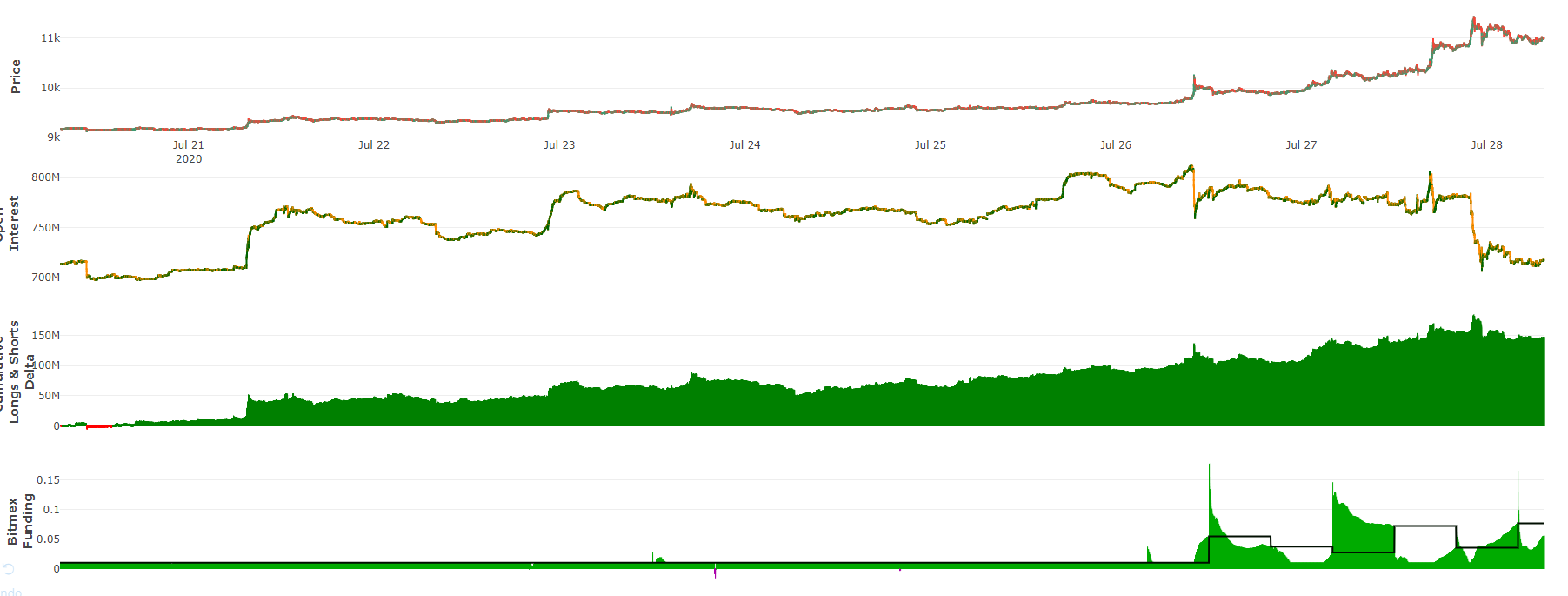

What some analysts see as the most tell-tale sign that Bitcoin could drop from here is the state of BTC futures.

Below is a chart from a cryptocurrency trader who predicted BTC would hit the $3,000s months before it did.

It shows that long positions on BitMEX have built up massive positions over the past week, resulting in a spike in the funding rate.

The funding rate is the rate that long positions pay short positions to normalize the price of futures to the spot price.

Chart from trader il Capo of Crypto (@CryptoCapo_ on Twitter)

The extremely high funding rates and positive long-short delta suggests that Bitcoin buyers may be overleveraged. Data from another source, which aggregates the funding rates of the top crypto futures platforms, also indicates this.

High funding rates are often seen at market tops, or at least at points in Bitcoin uptrends where the price slightly retraces.

#2: A CME Futures Gap In the High-$9,000s

Due to Bitcoin rallying on the weekend, it has formed a CME futures gap in the $9,600-9,900 range.

Analysis has found that 77% of all CME Bitcoin gaps fill within the week after they are formed. With this gap where it is, there is a high chance by historical standards that BTC revisits the high-$9,000s in the coming days.

The issue is that Bitcoin doesn’t have to fill in the CME gap. As one trader recently remarked:

“CME Gapped up leaving a $285 gap. Most of the time the narrative is a gap fill before continuation but we also need to keep in mind that this could very well be a breakaway gap. Breakaway gaps often occur early in a trend and show conviction in the new trend direction.”

#3: A TD Sequential “9” Candle on BTC’s Daily Chart

Finally, there remains a sell signal on Bitcoin’s one-day price chart. The signal is a Tom Demark Sequential “sell 9,” which is a candle formation often seen near or at the top of an asset’s trend.

Chart of BTC’s price action over recent months with the TD Sequential. Chart by a Telegram channel tracking TD Sequential signals; chart from TradingView.com

Traders have not seen any recent success with using this indicator — the chart above shows few TD “9” candles. Yet the creator of the indicator, Tom Demark, said in a Bloomberg interview that it managed to catch Bitcoin’s macro bottom at $3,150 and the 2019 highs near $14,000.

Related Reading: On-Chain Metric Signals the BTC Market Isn’t Overheated: Why This Is Bullish

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com These 3 Signs Indicate Bitcoin Could Drop After 20% Explosion to $11.5k