Ethereum has undergone a consolidation period for over the past month. Since the beginning of June, the second-largest cryptocurrency by market cap has mostly traded between the $217 support and the $250 resistance level. Such a narrow trading range has made it nearly impossible to determine what the future holds for Ether.

Nonetheless, the TD sequential index recently signaled that ETH was bound for a bearish impulse based on its 1-week chart. Data reveals that each time this technical index has provided a sell signal in the form of a green nine candlestick for over the past year, Ether takes a massive nosedive.

TD Index Presents Sell Signal On ETH's 1-Week Chart. (Source: TradingView)

Thus far, Ethereum has gone down roughly 12% since the TD setup turned bearish, but different on-chain metrics suggest more losses to come.

High Levels of Network Activity

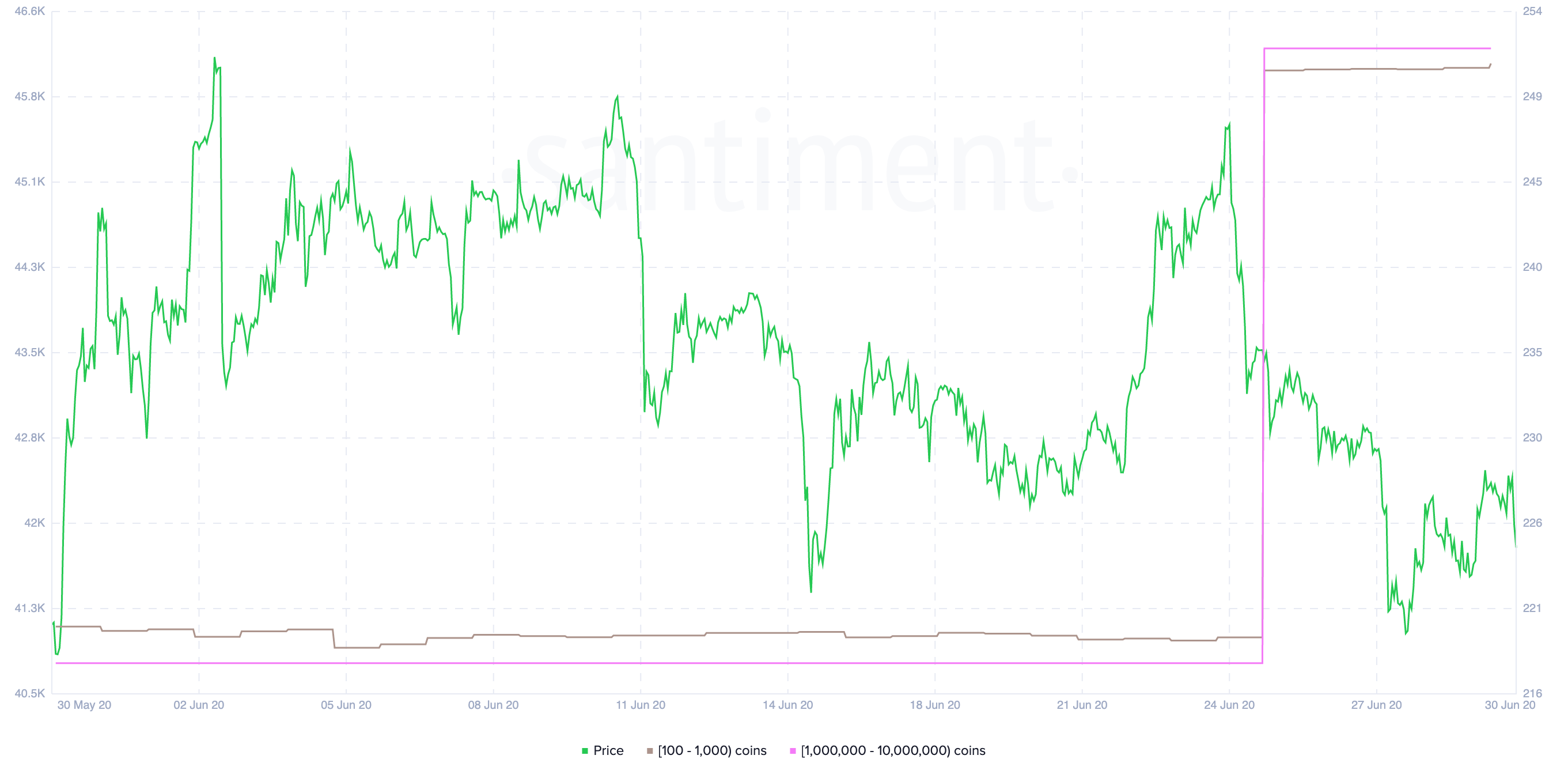

Ever since the perpetrators of the PlusToken Ponzi transferred 790,000 ETH to an address associated with mixer deposits, the network activity of this altcoin exploded. The number of addresses holding 1,000,000 to 10,000,000 ETH surged by 20% on June 24. Meanwhile, roughly 6,000 new addresses with 100 to 1,000 ETH joined the network on that day alone.

Larry Cermak, Director of Research at The Block, believes that such an impressive increase in the number of addresses holding Ether is not related to increasing adoption, but in fact, it has to do with PlusToken.

“This is literally just a massive bump from PlusToken splitting up one address into thousands of addresses. Some will be also from the DeFi growth, but compared to [PlusToken] very little. If you want to use this chart to prove that the adoption is increasing it needs to be heavily caveated,” said Cermak.

The Number of Ethereum Addresses Explodes. (Source: Santiment)

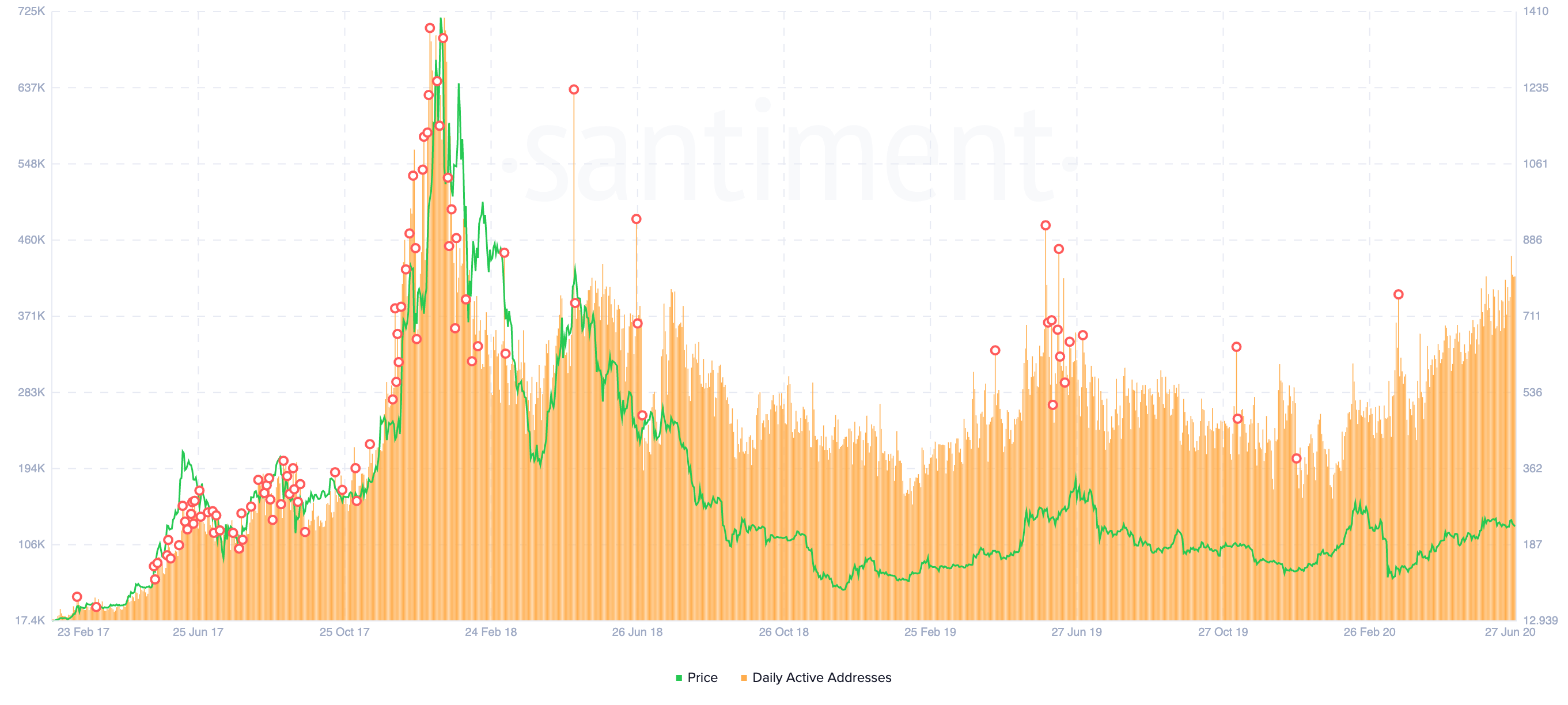

A similar spike was registered in the number of daily addresses on the Ethereum network, according to Santimet. The behavior analytics platform said that ETH daily active addresses rose to levels not seen since 2018.

“The number of daily addresses interacting with ETH has spiked in the past 24 hours to a 2-YEAR SINGLE DAY HIGH of 486,000 addresses! The last time Ethereum’s address activity was this high was on May 5th, 2018,” said Santiment.

Daily Active Ethereum Addresses Skyrocket To Levels Not Seen in Two Years. (Source: Santiment)

Based on historical data, spikes in daily active addresses have lined up with market tops. And given the significant number of tokens the individuals behind the PlusToken scam are off-loading, the probabilities of a steep correction increase exponentially.

Key Support Level to Watch Out

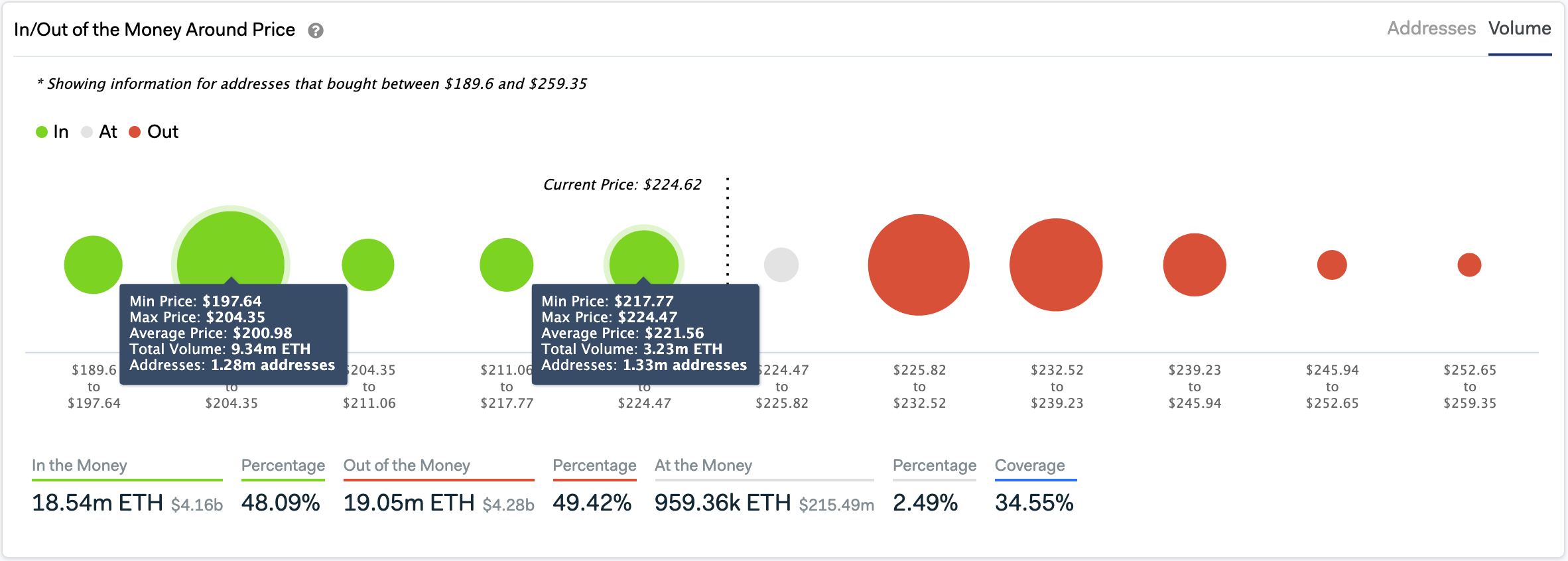

For this reason, investors must watch out for the $217 support level. Moving past this barrier could trigger a sell-off that sees Ethereum fall to $200 since there is not any significant barrier in-between based on IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model.

Weak Support Ahead of Ethereum. (Source: IntoTheBlock)

Holders within the $200 price range would likely try to remain profitable in their long positions preventing ETH from further losses.

Featured by Shutterstock.

Charts from TradingView.com