- Deribit has emerged as the most dominant Bitcoin derivatives exchange ahead of a massive expiry of options contracts on Friday.

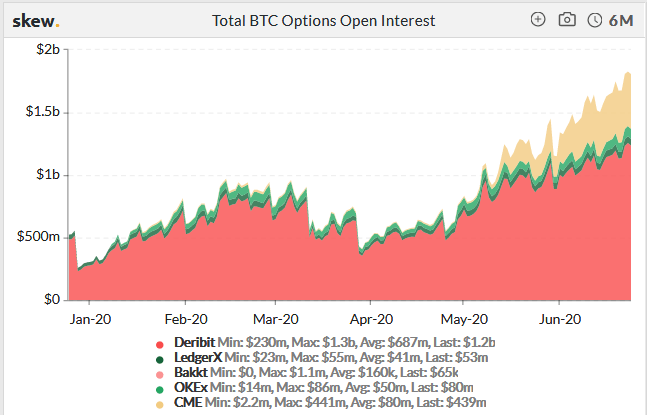

- The Panama-based firm now covers nearly 63 percent of the total open interest (OI) in the cryptocurrency market.

- The total number of outstanding bitcoin options contracts on Deribit has reached an average of 73,634. It is worth $675.3 million.

- In comparison, the total Bitcoin options OI on the Chicago Mercantile Exchange (CME) is just worth $80 million.

Deribit is dominating the Bitcoin options market by covering about 63 percent of its total open interest.

Data provided by Skew on Thursday revealed that the Panama-based crypto derivatives exchange has about 73,634 outstanding BTC options contracts that will expire on June 26. Based on the current rates, they amount to nearly $675.3 million, the highest in the options market.

Total BTC Options Interest. Source: Skew

Also, Deribit is also hosting $71.4 million worth of Ethereum options contracts, also set to expire on June 26. The exchange confirmed that its current open market total had breached the $1.4 billion level.

Meanwhile, the total number of outstanding contracts across all the exchanges is worth $2 billion. That includes U.S.-based Chicago Mercantile Exchange (CME), which is a better-regulated platform than Deribit but reflects only $80 million worth of open interest.

Cheaper Bitcoin Contracts

In 2019, Deribit had proved its dominance by engulfing over 95 percent of the entire derivatives market. Observed anticipated that the unregulated exchange would lose its sheen to the newly arriving and regulation-friendly platforms like Intercontinental Exchange’s Bakkt and CME.

However, Deribit’s sustained dominance over the crypto options market indicated that retail investors still prefer to trade on the non-U.S. exchanges. The sentiment favors Deribit also because it allows traders to open contracts for as little as 0.10 BTC.

CME entitles its bitcoin contracts at a comparatively higher 5 BTC.

In retrospect, options contracts give traders the right not commitment to purchase or sell the underlying bitcoin at a specified price. Those with call options expect to buy the cryptocurrency at a predetermined price – called strike price – ahead of the contract expiry date.

Meanwhile, those with put options gains the right to sell BTC. Both call and put options together sum up as the total number of outstanding, unsettled contracts. As Deribit closes-in to execute over $1 billion of these open positions on Friday, it marks the industry’s most significant options expiry ever.

Dependability

Deribit is also leading ahead of its competition with its ability to contain market risks. Realizing that the large expiry may prompt traders to roll over their open contracts to the next expiration date, the exchange has raised margin requirements for specific clients.

As a result, it would be more expensive for influential traders to skip the expiry. But, at the same time, the move would prompt them all to force-close their contracts.

The exchange confirmed that it would keep adjusting its margin requirements depending on the market volatility. Higher volatility makes options more expensive, allowing existing holders to sell their contracts at a higher rate.