- Ethereum is facing a strong resistance near the $152 and $155 levels against the US Dollar.

- The price seems to be consolidating above the $142 support area.

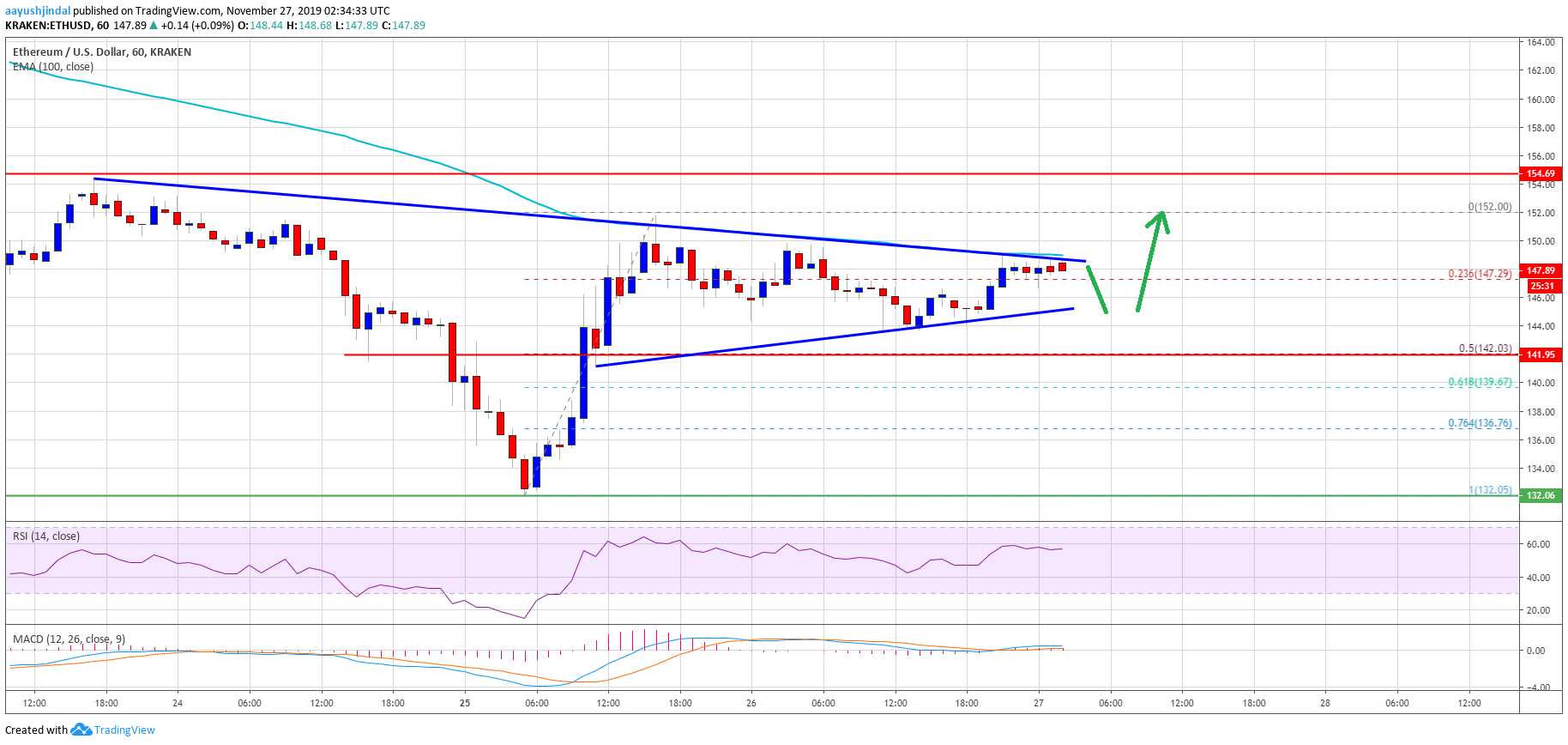

- There is a new key bearish trend line forming with resistance near $150 on the hourly chart of ETH/USD (data feed via Kraken).

- The price could dip a few points, but it is likely to make another attempt to break above $155.

Ethereum price is trading in a range after a decent recovery versus the US Dollar and bitcoin. ETH price must settle above the $155 resistance to start a strong rise.

Ethereum Price Analysis

Yesterday, we saw the start of a decent upside correction in Ethereum from the $132 swing low against the US Dollar. ETH price managed to recover above the $140 and $142 resistance levels.

Moreover, the price traded above the $150 level, but it struggled to continue above the $152 and $155 resistance levels. A high was formed near $152 and the price is now trading below the 100 hourly simple moving average.

Recently, there was a downside correction below the $150 level. Besides, the price dipped below the 23.6% Fib retracement level of the recent recovery from the $132 low to $152 high.

However, the $144 support is acting as a short term support. On the downside, there is also a connecting bullish trend line forming with support near $144 on the hourly chart of ETH/USD. If there is a downside break below the $144 support, Ethereum price could test the key $142 support.

Additionally, the 50% Fib retracement level of the recent recovery from the $132 low to $152 high is also near the $142 level. Therefore, a close below the $142 support area might start a fresh decline in the near term.

On the upside, there are many hurdles near $150, $152 and $155. More importantly, there is a new key bearish trend line forming with resistance near $150 on the same chart.

To move into a positive zone and start a solid increase, the price must break the $152 and $155 resistance levels. In the mentioned bullish case, the price is likely to accelerate towards the $165 and $170 levels.

Looking at the chart, Ethereum price is trading in a range above the $142 support. In the short term, there could be a downside correction towards the $142 level, but dips likely remain supported.

ETH Technical Indicators

Hourly MACD – The MACD for ETH/USD is currently moving slowly in the bullish zone.

Hourly RSI – The RSI for ETH/USD is currently well above the 50 level, with a few positive signs.

Major Support Level – $142

Major Resistance Level – $155

The post Ethereum (ETH) Won’t Go Quietly, Risk of Bounce Grows appeared first on NewsBTC.

Source: https://www.newsbtc.com/2019/11/27/ethereum-eth-wont-go-quietly-risk-of-bounce-grows/