Since April this year, significant moves by Bitcoin has seen the price pump from $4,100 to almost $14,000. Once again, cryptocurrencies are gracing the home pages of mainstream media outlets, and public interest is duly peaked.

Sentiment on whether crypto winter is indeed over still divides opinion, but Fundstrat’s Thomas Lee continues to push a bullish narrative. As long ago as May, following Consensus 2019, Lee cited 13 signs that a recovery is well underway. And in a recent interview, he even calls a Bitcoin year-end price of $40k.

After a disturbing pullback to ~$6,200, #Bitcoin back >$8,000 further cementing positive trend intact.

As we said a few weeks ago, Consensus 2019 @coindesk was to prove whether crypto winter is over…

…confirmed pic.twitter.com/M8ni4g2YvX

— Thomas Lee (@fundstrat) May 19, 2019

Bitcoin Expectations

With numerous factors in play right now, from CFTC futures approvals to the influence of Facebook’s Libra, to speculation on the SEC finally giving Bitcoin ETFs the green light, the rest of 2019 promises to be eventful.

And following recent price action, market anticipation of an extended bull-run is high. Indeed, fueled by growing institutional involvement, and a burgeoning realization that BTV isn’t going away, the expectation of blowing past $20,000 is immense.

In a recent interview, Lee presented his technical analysis of BTC and shared his reasoning by saying:

“This year has been a cascade of things that have reinforced that crypto winter is over. I think the first, most important thing was Bitcoin reattained its 200 day moving average. And in its 10 year history, whenever it’s above its 200 day, its price return is ten times better than when it’s below its 200 day… And then we had the golden cross, right, so the 50 day crossed above the 200 day.

And in a further acknowledgment of bullishness, Lee drew attention to the phenomenon of $10k FOMO. He said:

“I think that one of the key levels this year, something we’ve been writing about, was ten thousand, because that represented a price that Bitcoin’s only traded at in 3% of its history. So if you look at the prior cycles, anytime Bitcoin gets into that rare range. Like when its only traded, in 3% of its history, a type of FOMO kicks in. And I think we saw that dynamic, because as soon as broke about ten, we almost went straight to fourteen thousand.”

Bitcoin Year-end Price Prediction

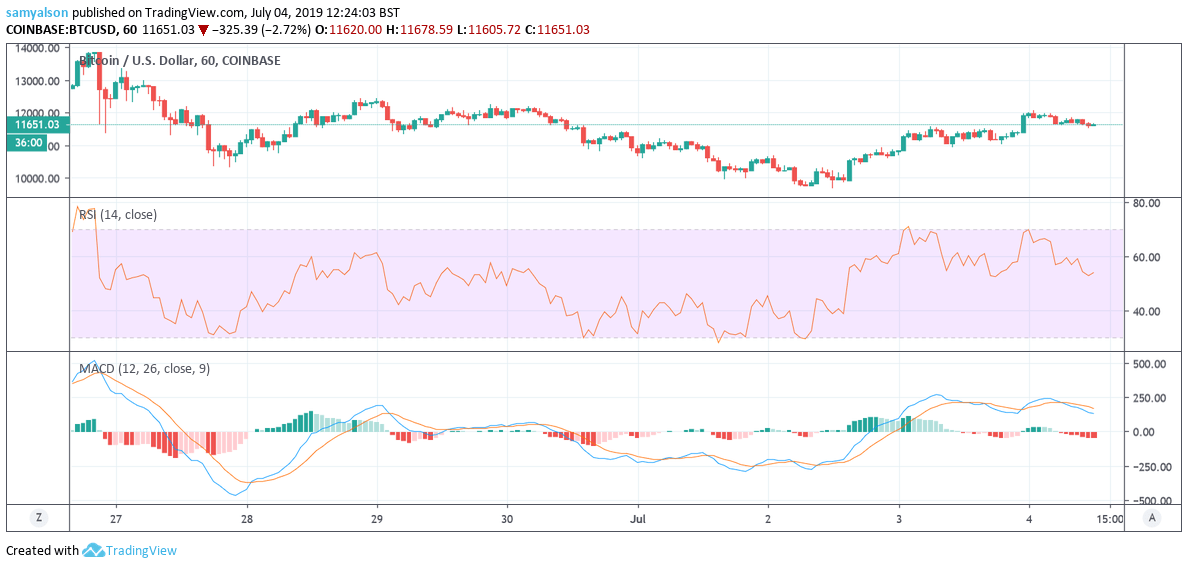

Price volatility and likely profit taking saw an end to the euphoria, as Bitcoin pulled back from $14,000. At present, Bitcoin/USD is showing an upward trend since July the 2nd. But, on a shorter timeframe, this morning saw the MACD cross back under the signal line, indicating a fall in BTC price in the short term. While RSI is heading towards the oversold territory.

All the same, when it comes to BTC price, crypto advocates expect a roller coaster ride. And in the case of Jimmy Song, volatility is simply a byproduct that comes with being decentralized and sovereign.

* Asking for a currency to be stable with respect to another currency is really asking for a peg.

* A peg to another currency necessarily means giving up sovereignty, esp. over the supply.

* The volatility of Bitcoin to USD is evidence it’s truly new. It’s a feature, not a bug.— Jimmy Song (송재준) (@jimmysong) July 1, 2019

Regardless of the current slump, Lee remains undeterred in his outlook. And when piecing together his train of thought, he makes his end of year prediction by saying:

“I think now, in people’s minds they have to think back to those past cycles. That once you break above that 3%, Bitcoin likely goes up two-hundred to four-hundred percent within the next four months. Which means it could be as high as forty thousand, before the end of the year.”

Featured image from Unsplash

The post Prominent Analyst Shares His Reasoning For $40,000 Bitcoin By 2019 appeared first on NewsBTC.

Source: https://www.newsbtc.com/2019/07/04/prominent-analyst-shares-his-reasoning-for-40000-bitcoin-by-2019/